Wells Fargo settlement: $56.85M CARES Act class action deal to benefit California homeowners

Wells Fargo will pay $56. 85 million to resolve a class action accusing the bank of misreporting CARES Act mortgage forbearances to credit reporting agencies. The settlement affects California homeowners who were current on their mortgages, entered CARES Act forbearance on or after March 27, 2020, and whose accounts were reported as "in forbearance" rather than "current. "

Who is in the class and what they will receive

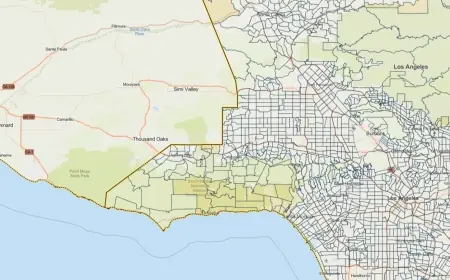

The settlement covers California mortgagors with a mortgage on property located in California who met three conditions: their mortgage account was current, they received a CARES Act forbearance on or after March 27, 2020, and Wells Fargo reported the account to a consumer reporting agency as "in forbearance" or with similar language. Plaintiffs alleged that such reporting violated the federal Fair Credit Reporting Act by inaccurately reflecting the accounts' status and harming consumers' credit profiles.

Wells Fargo has not admitted wrongdoing. Under the terms of the agreement, a $56. 85 million gross settlement fund will be established. After deductions for court-approved fees, costs and administration expenses, the remaining net fund will be distributed to class members in equal shares. Exact payment amounts depend on the number of participating class members and final deductions.

No claim form is required. Class members who do not timely exclude themselves will be eligible for automatic distribution. Checks will be mailed to the last known address on file following final approval. Recipients will have 90 days to cash their settlement checks. If significant funds remain after the first distribution, a second round of payments may be made; if remaining funds are insufficient for meaningful additional payouts, the remainder will be donated to Credit Builders Alliance, a nonprofit focused on helping low- and moderate-income consumers build credit.

Key dates, legal posture and next steps

The deadline to exclude oneself or to file an objection is March 25, 2026 (ET). The court’s final approval hearing is scheduled for April 17, 2026 (ET) in the Superior Court of California, County of San Diego, in the case styled Stoff v. Wells Fargo Bank N. A., Case No. 37-2020-00020808-CU-BT-CTL. If the court grants final approval, distributions to class members will proceed the settlement administrator’s schedule.

Class counsel has indicated that payments will be automatic for eligible class members who remain in the class, and that no additional paperwork is required to receive the initial distribution. Any class member who wishes to preserve the right to pursue an individual claim must follow the exclusion procedures by the March 25, 2026 deadline. Objections to the settlement must be submitted in writing and comply with the court’s stated requirements to be considered at the final approval hearing.

Practical impact for affected homeowners

For eligible borrowers, the settlement offers financial relief without the need for filing claims. The alleged misreporting, plaintiffs say, made it harder for affected consumers to obtain new credit or caused higher borrowing costs due to diminished credit scores. The settlement does not include an admission of liability, but it provides a path for compensation and potential second-distribution relief before any remainder is redirected to consumer-credit assistance work through Credit Builders Alliance.

Borrowers with questions about eligibility or procedural deadlines should review their case notices and the court filings tied to the Stoff matter. Those who believe they meet the eligibility criteria and who do not exclude themselves need only wait for the administrator’s distribution process following final approval.