Gold price today falls sharply after record run, with volatility back in focus

Gold price today swung lower in early U.S. trading on Friday, January 30, 2026 ET, after a blistering rally pushed the metal to fresh record territory a day earlier. The move included a brief dip below the $5,000 level, a reminder that momentum trades can reverse quickly when the dollar and interest-rate expectations shift.

By the morning, selling had eased from the session lows, but the day’s drop was still large enough to reset short-term sentiment.

Gold price today: Where it’s trading now

As of early Friday morning in New York, spot gold was around $5,150 per ounce (USD), down roughly 4%–5% on the day. The intraday range was wide, with buyers and sellers reacting to fast-moving rate and currency signals rather than any single headline.

Here’s a quick snapshot at about 7:05 a.m. ET:

| Measure | Level (USD) | Approx. day move |

|---|---|---|

| Spot gold (1 oz) | 5,150 | -4.6% |

| Spot gold (1 gram) | 166 | -4.6% |

| Spot gold (1 kilogram) | 165,560 | -4.6% |

What sparked the sudden drop

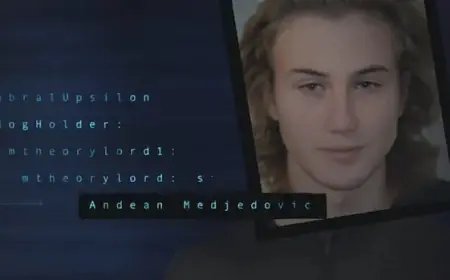

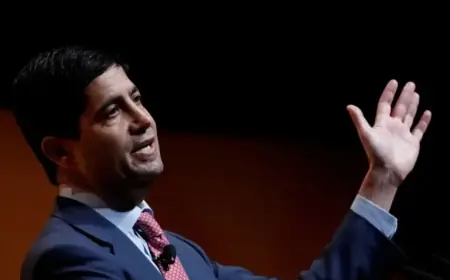

The immediate pressure came from a familiar mix: a firmer U.S. dollar, higher yields, and a rethink of how restrictive policy could get from here. Traders also reacted to renewed talk that Kevin Warsh could be selected as the next Federal Reserve chair, a development markets broadly interpret as less friendly to the “easy money” narrative that often supports precious metals.

When the market prices in tighter financial conditions, non-yielding assets tend to lose some shine — not because the long-term story disappears, but because the short-term cost of holding them rises.

A pullback doesn’t erase January’s surge

Even with Friday’s slide, the month’s performance still stands out. The metal entered the final trading day of January with a massive gain for the month, reflecting a period where investors leaned hard into inflation hedges, portfolio protection, and outright momentum.

That’s why today’s move feels dramatic: it’s not just a down day — it’s a sharp reversal after a near-vertical climb that took prices to a record above $5,590 on Thursday. The speed of the rise invited crowded positioning, and crowded positioning tends to produce abrupt air pockets when the narrative wobbles.

Demand is real, but positioning is driving the tape

Underlying appetite hasn’t vanished. Physical buying interest in key markets has remained strong at times, and longer-term investors still treat the metal as a diversification tool. But day-to-day pricing is being dominated by futures positioning, leveraged trades, and the constant tug-of-war between “store of value” demand and “rates are rising” pressure.

That creates an environment where swings of 2%–5% in a single session become plausible, especially when psychological levels — like $5,000 — come into view.

What to watch next

The near-term path will likely hinge on a few big inputs:

-

U.S. dollar direction: A sustained dollar bid can keep pressure on bullion.

-

Treasury yields and rate expectations: Shifts here tend to show up quickly in metals.

-

Policy messaging: Any clearer signals about the Fed leadership outlook could move markets again.

-

Volatility and liquidity: After a parabolic run, the market can stay jumpy even without fresh catalysts.

For now, the story is less about a single data point and more about a regime change in tone: after record highs, the market is forcing a repricing of risk — and it is doing it in real time.