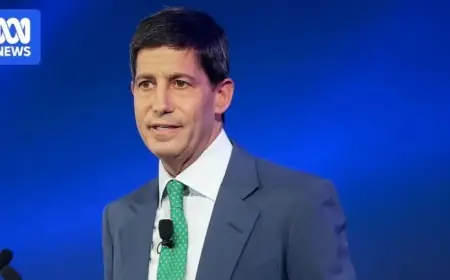

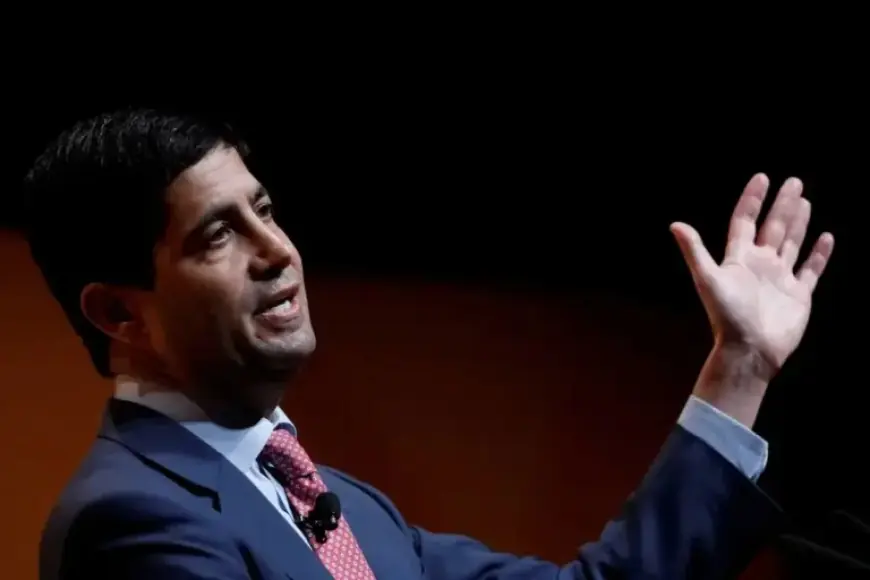

Trump Appoints Ex-Fed Governor Kevin Warsh as Next Federal Reserve Chair

U.S. President Donald Trump announced his intention to nominate Kevin Warsh as the next chair of the Federal Reserve, following Jerome Powell’s term expiration in May. This appointment reflects a significant anticipated shift in the Federal Reserve’s governance, possibly bringing it closer to the White House and altering its longstanding independence.

Background on Kevin Warsh

Kevin Warsh, 55, previously served on the Federal Reserve’s board from 2006 to 2011, making him the youngest governor in the institution’s history at the age of 35. He is currently a fellow at the Hoover Institution and lectures at Stanford Graduate School of Business.

While Warsh has historically been known as an advocate for higher interest rates to combat inflation, he has recently expressed support for lower rates, aligning with Trump’s views that the Fed’s key rate should be as low as 1 percent, significantly below its current rate of approximately 3.6 percent.

Implications of Warsh’s Appointment

Trump’s decision to appoint Warsh aims to exert more control over the Federal Reserve, which is one of the few independent federal entities. Over the years, Trump has publicly criticized the Fed and its chairman, Jerome Powell, for not implementing quicker interest rate cuts.

- Warsh could replace Powell upon his term’s completion in May.

- He previously objected to the Fed’s low-interest rate policies during the 2008-09 Great Recession.

- Concerns about inflation have been a consistent theme in Warsh’s career.

Challenges Ahead

If confirmed, Warsh will navigate a complex political landscape within the Federal Reserve. He will join a rate-setting committee, with 12 voting members who hold differing opinions on interest rates. Some members prioritize combating persistent inflation, while others advocate for lower rates to stimulate a faltering economy.

Financial markets may also respond cautiously to aggressive rate cuts, fearing the inflationary repercussions of political influences on the Fed.

Warsh’s Professional History

Before his Federal Reserve tenure, Warsh served as an economic aide during George W. Bush’s administration and was a notable investment banker at Morgan Stanley. His close collaboration with former Fed chair Ben Bernanke during the financial crisis highlighted his importance in the institution.

In recent months, Warsh has critiqued the Fed’s direction under Powell, particularly regarding its engagement in broader social issues that he believes distract from its primary economic mandate. He has called for a fundamental change in the Fed’s approach to policy, reflecting a shift in priorities if he assumes the chair position.

Conclusion

Kevin Warsh’s potential nomination as Federal Reserve Chair signals a pivotal moment in U.S. economic policy. His views on interest rates and the Fed’s role in markets suggest that his leadership could reshape the agency in ways that align more closely with Trump’s economic vision. The Senate confirmation process will be a key moment in determining the future direction of the Federal Reserve.