BlackRock Bitcoin ETF Options Intensify Crypto Market Meltdown

BlackRock’s spot bitcoin exchange-traded fund (ETF) has experienced a significant surge since its launch, attracting billions from investors eager for cryptocurrency exposure without managing digital wallets. This interest has led to increased scrutiny of inflows into the fund as a measure of institutional market positioning. However, recent market developments have shifted focus to options activity linked to the ETF, especially in light of a crash that occurred recently.

Record Options Activity Amid Market Turmoil

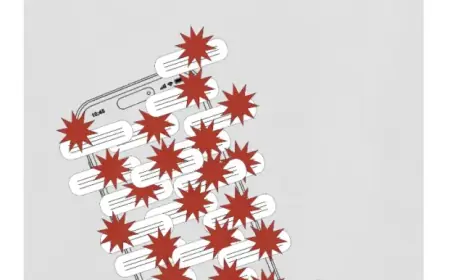

On a troubling Friday, the ETF’s value plummeted by 13%, hitting its lowest level since October 2024. Concurrently, options trading surged, with a remarkable volume of 2.33 million contracts, significantly favoring puts over calls. This demand for puts indicates a heightened need for downside protection, a common reaction during market sell-offs.

The Mechanics of Options Trading

- Call Options: Allow buyers to lock in a purchase price for bitcoin and profit if market prices rise.

- Put Options: Enable sellers to secure a selling price, providing profit if market prices fall.

On the day of the crash, buyers of bitcoin options collectively paid a staggering $900 million in premiums, marking the highest daily total on record. This amount rivals the market capitalization of numerous lesser-ranking cryptocurrencies.

Speculative Theories Surrounding Market Activity

An analysis by market expert Parker suggested that the spike in options activity was closely linked to a hedge fund facing significant losses. This fund had allegedly invested almost its entire portfolio in bitcoin and struggled to meet margin calls as prices declined. The resulting forced sales contributed to a staggering $10 billion in spot trading volume for bitcoin.

Parker’s theory posits that this fund initially purchased “out of the money” call options, expecting a market rebound that never materialized. As bitcoin prices continued to drop, the fund doubled down on its positions with borrowed funds, exacerbating its losses.

Contrasting Expert Opinions

Contrarily, Tony Stewart, an expert in options trading, downplayed Parker’s hedge fund theory. He highlighted that a significant portion of the premiums, around $150 million, came from traders buying back put options to mitigate losses. Stewart believes that the options volume reflects a panicked market rather than a specific event or fund collapse.

Conclusion: The Growing Influence of Options in Crypto Markets

This recent wave of options activity signals a noteworthy trend in the cryptocurrency market, particularly regarding how options based on ETFs can influence price movements. Whether driven by a singular hedge fund or a more chaotic market response, these developments underscore the importance of monitoring options alongside traditional ETF inflows in future trading strategies.