AI Devours Software, Costs Atlassian Duo $34.6 Billion

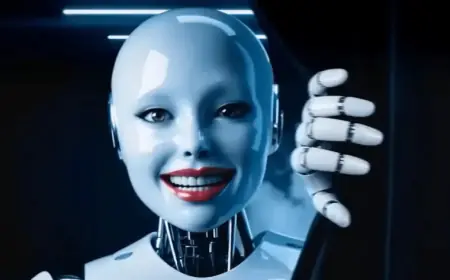

Recent developments in artificial intelligence have cast a shadow over software companies, raising critical concerns for investors and industry leaders alike. The Australian tech landscape, particularly firms like Atlassian, Canva, and Xero, is feeling the pressure as AI tools advance rapidly.

AI Threatens Software Giants

On February 7, 2026, a new AI productivity tool named Claude Cowork, developed by Anthropic, stirred fears in the tech community. This tool is designed to automate tasks in the legal sector, prompting questions about its potential to disrupt established software applications.

Barclays recently highlighted this existential threat in their research, suggesting it could spell the end for traditional software. Legal and publishing software firms, including Thomson Reuters, have already seen significant declines in their market valuations.

Impact on Market Valuations

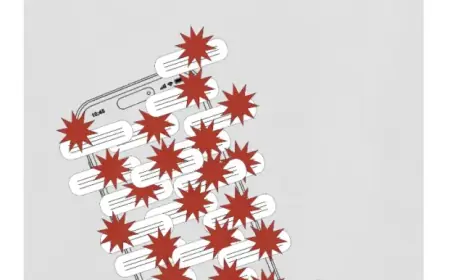

By midweek, the ramifications of these fears had cascaded, erasing over $1 trillion in market value for software and fintech sectors globally. This downturn also affected private equity firms like Blackstone and KKR, which have heavily invested in software companies.

- Losses surpassed $1 trillion by week’s end.

- Fears of AI’s impact spread from legal to data-focused companies.

- Investors are wary of high-margin software firms’ futures.

Concerns Among Investors

Australian companies are not immune. Atlassian’s share price has dropped significantly, reflecting investor apprehensions about competition from AI-native solutions. Meanwhile, Xero reported a stark decline in its stock value, prompting a reassurance campaign from CEO Sukhinder Singh Cassidy regarding their AI strategy.

Real estate firms, such as REA, also face challenges as AI capabilities increase. Potential buyers may bypass agents by utilizing AI tools, diminishing the need for traditional listings.

Valuations and the ‘SaaSpocalypse’

The current situation has led to a term coined by traders: “SaaSpocalypse.” Analysts now draw parallels between the software sector’s challenges and the decline of print media and department stores. Atlassian co-founders Mike Cannon-Brookes and Scott Farquhar have strived to reassure stakeholders about their long-term strategies amid declining stock prices.

Canva, once valued over $40 billion, is also under scrutiny as market fears escalate. Adobe has experienced a 40% decline in share price over the past year, reflecting broader anxieties about the impact of AI on software licensing.

The Shift Toward AI Investment

The capital dynamics are shifting. Venture capital spending on AI start-ups surged, with 60% of investments targeted at AI-centric businesses in 2025. New players like Alex McLeod’s Serval, valued at over $1 billion, are capturing attention.

As traditional software firms adjust to the rapid rise of artificial intelligence, the question remains: which companies will adapt successfully, and which will falter?

- Venture capitalists invested $5 billion in start-ups last year.

- AI start-ups are attracting a significant portion of venture funding.

- Market sentiment is shifting towards AI-driven solutions.

For Australia’s tech heavyweights, the forthcoming months will be critical. The intersection of AI and software development could redefine the landscape, but it remains to be seen which firms will emerge as winners.