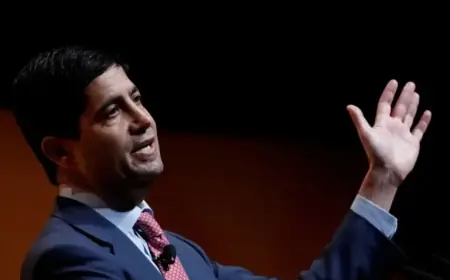

Real Brokerage CEO Faces Lawsuit Linked to Agent’s Divorce

A lawsuit has been filed against Tamir Poleg, CEO of The Real Brokerage, involving claims of marriage interference. Michael Steckling, a resident of Utah, seeks $5 million for “alienation of affection,” alleging that Poleg disrupted his marriage to Paige Steckling.

Details of the Lawsuit

The case, initiated on October 21, 2025, began in a Utah district court before transitioning to the U.S. District Court for the District of Utah. Michael Steckling asserts that Poleg knowingly interfered in his marriage during his tenure as CEO of The Real Brokerage.

Allegations of Financial Incentives

- Steckling contends that Poleg offered his wife significant financial support, including hundreds of thousands of dollars and a multimillion-dollar home in Park City, Utah.

- On February 3, 2025, Poleg allegedly emailed Paige Steckling with instructions to access $1.5 million.

- On the same day, Poleg reportedly sold over $600,000 worth of stock from The Real Brokerage, claiming the sale was to fund the purported financial support.

According to the complaint, Paige filed for divorce three days after the email, with Poleg’s actions cited as the primary cause for the marriage’s breakdown.

Poleg’s Defense

Poleg has rejected the allegations both in court and in communications with Real Brokerage agents. He claims the lawsuit seeks to exploit his public position for personal gain and asserts that he did not intentionally interfere in Steckling’s marriage.

Key Responses

- Poleg acknowledges a past relationship with Paige Steckling but states it ended nearly a year ago.

- He denies offering any financial incentives for her to leave her husband.

- While he admits to sending an email about financial support, he contends it was in response to her request.

Current Status and Financial Context

The case remains pending, with no findings made in court as yet. Both parties dispute the portrayal of the Stecklings’ marriage as committed and loving, with Poleg asserting that Paige had previously expressed intentions to separate.

Poleg’s Stock Sales

Filings from the Securities and Exchange Commission (SEC) show that on February 3, 2025, Poleg sold 125,000 shares of REAX stock, valued at nearly $620,000 at that time. Over the course of 2025, he sold approximately 4.62 million shares, totaling a market value of $21.3 million. Notably, Steckling’s suit does not raise issues regarding securities violations, and there have been no regulatory findings connecting Poleg’s stock sales to any misconduct.

The ongoing legal battle highlights the complexities of personal relationships within high-profile positions and raises questions surrounding the implications of financial support in such situations.