Davos 2026: Indian Investors Navigate FIIs Amid Global Tensions

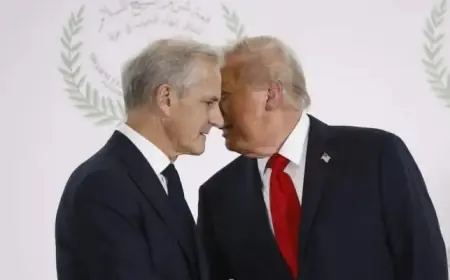

The upcoming 2026 World Economic Forum in Davos is drawing significant attention, particularly regarding U.S. President Donald Trump’s anticipated policies. The forum will take place from January 19 to 23 in Davos, Switzerland, with this year’s theme centered around ‘A Spirit of Dialogue.’ However, the atmosphere among investors is cautious due to rising geopolitical tensions and trade uncertainties.

Davos 2026: Impact of U.S. Policies on Global Markets

Investors are increasingly focused on how Trump’s potential tariff proposals will affect global markets. Dr. VK Vijayakumar, Chief Investment Strategist at Geojit Investments, voiced his concerns. He noted that if Trump imposes a 10% tariff on eight European countries starting February 1, 2026, with plans to increase it to 25% by June, it could trigger retaliatory measures. Such a trade war could harm global economic growth.

India-U.S. Trade Relationship in Question

- Negotiations for an India-U.S. trade deal have stalled, raising concerns among investors.

- Trump has supported sanctions on Russia, which may impose tariffs up to 500% on countries importing Russian oil, impacting India significantly.

Recent data reflects a worrying trend for Indian markets. Foreign Institutional Investors (FIIs) have offloaded ₹8,400 crores worth of Indian stocks in January 2026 alone. In 2025, FIIs recorded substantial outflows totaling $18.8 billion, with the trend of selling emerging from July onwards. This shift is attributed to high valuations, stagnant earnings, and broader macroeconomic risks.

Optimism Amid Challenges

Despite these challenges, some analysts remain hopeful. JM Financial projects a 9.8% year-on-year increase in Nifty50’s profit after tax (PAT) for Q3 FY26, buoyed by strong performances in sectors like IT, autos, and telecom. Similarly, Axis Securities anticipates revenue growth of 11.8% and EBITDA growth at 9.7% year-on-year.

However, experts caution that strong earnings alone may not attract foreign investors without clearer trade conditions. Vijayakumar emphasized the critical need for an India-U.S. trade deal to maintain macroeconomic stability. He warned of potential widening trade deficits, a depreciating rupee, and increased capital outflows if uncertainties persist.

Future Considerations for Investors

Financial analysts like Shrikant Chouhan of Kotak Securities and Ajit Mishra of Religare Broking underline key factors for renewed FII interest. They suggest that sustained inflows will depend on weaker performance in U.S. markets, declining bond yields, and clearer trade relations.

As Trump prepares to speak at the forum, global investors will scrutinize his statements. The decisions made in Davos regarding tariffs, sanctions, and trade deals could have significant repercussions for emerging markets throughout 2026.