Big Tech Fuels $600 Billion AI Boom in Modern Gilded Age

Big Tech is experiencing a significant transformation fueled by artificial intelligence (AI), leading to an unprecedented $600 billion investment boom. Companies like Amazon, Alphabet, Microsoft, and Meta are making extensive capital expenditures, primarily focused on enhancing data center capabilities. This escalation in spending is being compared to major economic eras, including the Gilded Age of the late 1800s.

Capital Expenditures on the Rise

Industry projections indicate that capital expenditures for Big Tech will surpass historical spending levels. By 2026, this spending is expected to set new records, suggesting a robust push in private-sector infrastructure development.

- Amazon: Plans to invest $200 billion, a 50% increase from 2025, marking the largest budget in the sector.

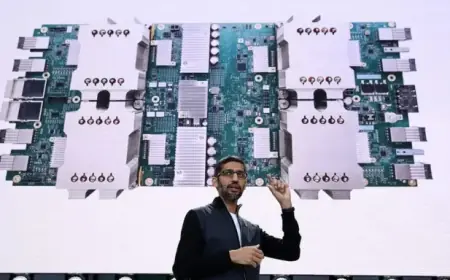

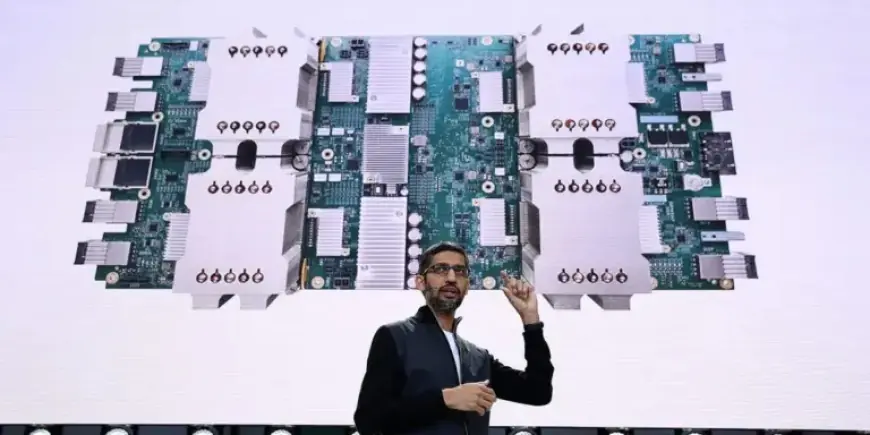

- Alphabet (Google): Announced a budget between $175 billion and $185 billion, doubling its capex for the second consecutive year.

- Meta: Aims for a capital expenditure of $115 billion to $135 billion, nearly doubling its figure from last year.

- Microsoft: Reported $37.5 billion in capital expenditures for Q2 2026, with projections up to $97.7 billion for the year.

Investors Concerned

Despite these ambitious plans, investor sentiment appears cautious. Following recent earnings announcements, stocks of Amazon, Microsoft, and Meta experienced declines. Analysts emphasize that investors are looking for concrete results rather than mere promises.

Amazon’s stock fell by up to 10% after its earnings call. Mark Shmulik, a Bernstein analyst, noted that the company might need to increase its guidance even further to salvage investor confidence.

Specific Company Developments

Alphabet’s substantial capex stems from the increasing demand for its Gemini AI models, which now boast over 750 million monthly users. BNP Paribas analyst Nick Jones backed this optimism, stating that Alphabet is well-positioned to lead in the AI sector.

Meta’s finances initially pleased investors, evidenced by an 8% stock increase following its earnings report. However, enthusiasm has since diminished, signaling a downward trend in stock performance.

Meanwhile, Microsoft’s reliance on OpenAI is critical, as it constitutes 45% of its backlog. However, the company’s stock dropped 12% immediately following its earnings announcement, marking its largest drop since March 2020, despite a strong revenue report.

Conclusion

The concerted push for AI investments by these tech giants is reshaping the landscape of technology and finance. As they navigate this modern Gilded Age of innovation, the ultimate question remains: Will these investments yield satisfactory returns for stakeholders?