Bitcoin Climbs to $65,000, Facing Biggest Weekly Decline Since 2022

Bitcoin experienced significant fluctuations recently, climbing back above $70,000 following a steep decline. After reaching a 16-month low, it surged nearly 11% to $70,042. Earlier, it had fallen to $60,017.60, highlighting the volatility in the cryptocurrency market. Despite this rebound, Bitcoin remains down about 9% for the week.

Market Overview

Market analysts believe this may reflect a temporary consolidation phase for risk assets. Shaun Osborne, chief currency strategist at Scotiabank, noted that Bitcoin’s recent performance aligns with broader trends in technology shares and precious metals. The digital currency market has struggled to regain investor confidence since last October, when Bitcoin plummeted from its all-time high.

Historical Context

Friday’s low marked Bitcoin’s weakest level since early October 2024, just before the cryptocurrency saw a revival influenced by political developments in the U.S. Market participants, however, express caution regarding recovery efforts.

Investor Sentiment

- Data from Derive.xyz indicated increased demand for downside protection.

- Put open interest concentrated on the $60,000 to $50,000 strikes for expiration on February 27.

- Investors seem to anticipate Bitcoin may continue to fall.

Sean Dawson from Derive.xyz highlighted the aggressive downward trend, suggesting that while Bitcoin’s fundamentals may be sound, the current market sentiment is bearish.

Performance of Other Cryptocurrencies

Ethereum also mirrored Bitcoin’s gains, rising by 10.7% to reach $2,045. However, it’s down more than 10% for the week after previously dropping to a 10-month low.

Crypto Market Losses

The global cryptocurrency market has faced significant losses, amounting to approximately $2 trillion since early October. Despite Friday’s bounce, over $1 trillion has evaporated within the past month alone.

The sell-off across risk assets, including precious metals and stocks, has contributed to this situation. Gold and silver, notable for their extreme volatility recently, regained some momentum with silver up 8.3% and gold rising about 4% on Friday.

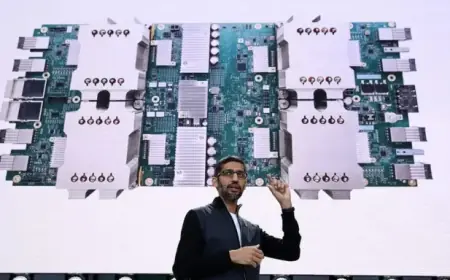

Correlation with Tech Stocks

Bitcoin’s price trends often correlate with the tech sector’s performance. Recent recoveries in the S&P 500 and Nasdaq suggest a renewed interest among investors in riskier assets. Notably, chip stocks have played a crucial role in this rebound.

Market Insights and Future Outlook

Analysts at Deutsche Bank reported significant outflows from U.S. spot Bitcoin ETFs, which totaled over $3 billion in January alone. Previous months also saw substantial withdrawals, indicating a cautious approach among investors. Observers are keen to see if Bitcoin’s recovery above $65,000 indicates a broader market revival.

As the market continues to navigate through volatility, the implications for Bitcoin and the broader cryptocurrency landscape remain a topic of significant interest among investors and analysts alike.