Stellantis Resets Business Strategy, Incurs Major Charges as Shares Plummet

Stellantis, the parent company of well-known brands like Jeep and Chrysler, has recently announced a significant shift in its business strategy. The decision comes after substantial investments in electric vehicles (EVs) did not yield expected results. As part of this reset, Stellantis is set to incur charges exceeding $26 billion, largely consisting of write-offs and cash payments related to canceled EV projects and the restructuring of its EV supply chain.

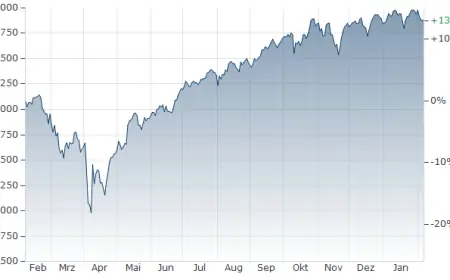

Impact on Share Prices and Industry Trends

This announcement had an immediate effect on Stellantis shares, which plummeted by as much as 30%. The strategic revision aligns with similar costly maneuvers by major automotive players like Ford and General Motors in recent weeks. Several U.S. manufacturers heavily invested in electric projects in anticipation of stringent environmental regulations introduced by the Biden administration and expected state bans on gasoline-powered vehicles within a decade. However, the regulatory landscape has shifted, particularly with the Trump administration rolling back these emissions rules and contesting states’ rights to implement stricter regulations.

CEO Statement on Financial Adjustments

Stellantis CEO Antonio Filosa commented on the €22.2 billion (approximately $26.2 billion) charges, stating they “largely reflect the cost of over-estimating the pace of the energy transition.” The company emphasized that the move towards electric vehicles should be driven by consumer demand rather than regulatory mandates, reinforcing its commitment to providing options for customers who may prefer hybrid or advanced internal combustion engine vehicles.

Reassessment of EV Demand and Future Outlook

In light of decreased forecasted demand for EVs, Stellantis indicated that the bulk of the financial charges—around €14.7 billion ($17.37 billion)—is related to realigning their product plans with shifting customer preferences and new emissions regulations in the United States. The company is expected to report its earnings for 2025 on February 26 and revealed a net loss for the current year, leading to the cancellation of its annual dividend in 2026. However, Filosa expressed a more optimistic outlook for the ongoing year, predicting continued profitability throughout 2026.

Regulatory Changes and Market Expectations

A recent decision by the European Union regarding the sale of new combustion engine vehicles by 2035 also casts a shadow over the shift to cleaner vehicles. After lobbying from automotive manufacturers, the EU’s executive branch stated that the ban would apply to only 90% of new vehicles produced, allowing the remaining 10% to be hybrids or combustion engine models.

Challenges and Comparisons of Vehicle Emissions

The adoption of EVs in Europe has not met the expectations of manufacturers, partly due to inadequate charging infrastructure across the continent. Evaluating the environmental impact of vehicles is complex, as it requires consideration of their entire life cycle, including manufacturing. Studies show that gas-powered cars, hybrids, and EVs emit similar amounts of pollution during production, except for battery manufacturing. Fully electric vehicles are found to be about 40% more carbon-intensive to produce than their gas-powered counterparts.

- Gas-powered vehicles have the cleanest production emissions but the highest lifetime emissions.

- Electric vehicles may be dirtiest to manufacture but produce the least carbon pollution over their lifetimes—40% less than gas-powered cars.

As Stellantis navigates these challenges, its revised strategy may significantly alter its future in the electric vehicle market.