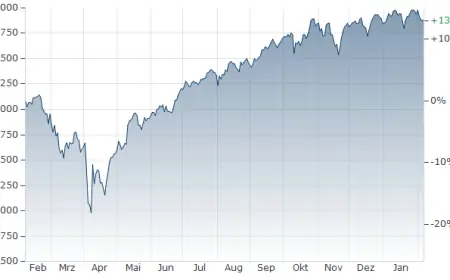

S&P 500 Declines in 2026 Amid Mounting Wall Street Job Market Concerns

The latest market trends reveal mounting concerns about the job market, which have significantly impacted the S&P 500. Recent labor data indicates a troubling rise in layoffs and a marked decline in job openings. This news has fostered pessimism, undermining previous optimism about economic growth.

S&P 500 Declines Amid Job Market Worries

On February 5, 2026, stock market performance highlighted these rising concerns. The S&P 500 index fell by 1.2%, marking a shift into negative territory for the year. This downturn was echoed by other major indices, with the Dow Jones Industrial Average also dropping by 1.2% and the Nasdaq Composite declining by 1.6%.

Sector Performance

Nine of the eleven sectors within the S&P 500 experienced declines. The broad sell-off points to the growing anxiety among investors regarding the labor market. As uncertainty lingers, market analysts are closely monitoring employment trends and their potential effects on the economy.

Summary of Market Moves

| Index | Change | Year-to-Date Performance |

|---|---|---|

| S&P 500 | -1.2% | Negative |

| Dow Jones | -1.2% | Not Provided |

| Nasdaq Composite | -1.6% | Not Provided |

As these economic indicators unfold, investors remain cautious. The drop in job openings and increase in layoffs could suggest a shift in market dynamics. Ongoing attention to the labor market will be essential for forecasting future trends.