Starmer Concerns Shake FTSE 100; Major Tech Stocks Decline

Investor sentiment in the UK has been shaken due to ongoing concerns surrounding Keir Starmer’s leadership. Speculation about his future has contributed to a notable decline in the pound, UK equities, and long-dated government bonds.

Market Reactions to Political Uncertainty

Amid rising political uncertainty, the UK’s yield curve, which denotes the difference in interest rates between short- and long-term debt, reached its highest level since 2018 on February 5, 2026. This indicates that investors are growing doubtful about the long-term viability of the UK economy.

Despite an improving outlook for interest rates, the yield on the 10-year gilt remains elevated. This benchmark reflects the government’s long-term borrowing capacity. Market analysts suggest that the speculation surrounding a potential leadership change, with the prospect of looser fiscal policies, is influencing these trends.

- Keir Starmer’s leadership is under scrutiny.

- The UK yield curve reached its highest point since 2018.

- 10-year gilt yields stay high amid political speculation.

Impact on Tech Stocks

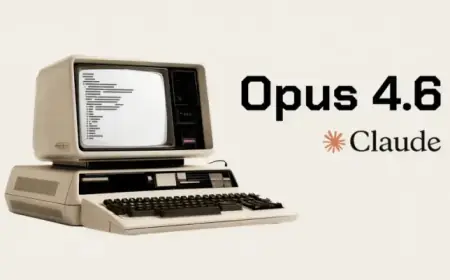

The situation is not limited to the UK. In the US, major technology stocks have faced a downturn for three consecutive days. Investors are adopting a risk-averse approach, resulting in significant losses for software companies. This market unease was exacerbated by the recent debut of Anthropic’s new AI tool, which has caused jitters across the software sector.

While the FTSE 100’s software companies like Sage, the London Stock Exchange Group, and Relx managed to recover some of their previous losses, the pressures on tech stocks in the US persist.

Looking Ahead

With political instability and market fluctuations affecting investor confidence, analysts are left wondering if this marks the beginning of a downturn for the AI sector. The interconnected challenges facing both UK and US markets underscore the need for stakeholders to navigate these uncertainties carefully.

As events unfold, the outcomes of Starmer’s leadership decisions will remain crucial for UK economic stability and investor sentiment moving forward.