Gold price today january 30 2026 tumbles after Fed chair pick jolts markets

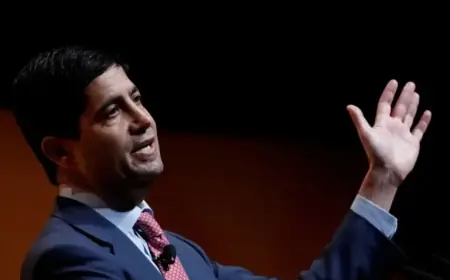

Gold is sharply lower on Friday, Jan. 30, 2026, after a violent pullback from Thursday’s record high. The selloff comes as the U.S. dollar firms and traders reassess rates and risk following President Donald Trump’s move to nominate Kevin Warsh to succeed Jerome Powell as Federal Reserve chair when Powell’s term ends in May 2026. The drop has been steep enough to briefly push spot gold below $5,000 overnight before buyers returned.

Gold price today january 30 2026: levels to know now

Prices and percentage moves vary by data feed and timestamp, but the direction is uniform: down hard from a record-setting Thursday.

| Measure | Level (ET) |

|---|---|

| Spot gold (XAU/USD, ~9:02 a.m.) | $5,054/oz (down ~5.9% on the day) |

| Spot gold intraday range | ~$4,942 to $5,451/oz |

| Overnight low (spot) | $4,957/oz (brief dip below $5,000) |

| U.S. gold futures (Feb, early morning) | $5,082/oz (down ~4.6%) |

| Thursday record high (spot) | $5,594.82/oz |

The headline that flipped the tape

Gold’s retreat accelerated as markets digested the Fed leadership news. Warsh, a former Fed governor, has been widely viewed as more hawkish by instinct than some other names floated in recent weeks, even as he has recently spoken favorably about lower rates. The nomination matters because it can reshape expectations for the future path of interest rates, the dollar, and the Fed’s posture toward inflation and financial conditions.

A stronger dollar is often a headwind for gold because the metal is priced in dollars, making it more expensive for many non-U.S. buyers when the currency rises. But Friday’s move looks bigger than a standard “dollar up, gold down” session—this is also about positioning after an outsized run.

Profit-taking after a historic run

The speed of January’s rally left gold vulnerable to a sharp air pocket. Even with Friday’s slump, the metal remains up dramatically for the month, following a near-vertical climb that brought repeated records in a matter of days. That kind of move tends to attract leveraged momentum trading—and when the direction turns, the unwind can be sudden.

The day’s action has also shown classic “crowded trade” behavior: once key levels broke (especially the round-number $5,000 area), the selling appeared to intensify, then ease as bargain hunters and short-covering stepped in. The fact that other precious metals dropped even more reinforces the idea that this is a broad deleveraging event across the complex rather than a gold-only story.

Spillover across silver, platinum, and palladium

Friday’s pullback has not been isolated. Silver, platinum, and palladium have all taken heavy hits, with silver especially volatile after its own record-setting stretch earlier in the week. When multiple metals fall together in large percentages, it often signals a risk-reset in futures markets—margin calls, position reductions, and systematic selling—rather than a change in the physical supply-and-demand picture alone.

That matters for what comes next: if the move is mostly mechanical and positioning-driven, prices can stabilize quickly once the forced selling is absorbed. If it reflects a deeper repricing of rates and the dollar, the bounce may be slower and choppier.

Physical demand: support, but not a cure-all

Physical buying has been an important pillar behind gold’s surge, particularly in Asia. Elevated local premiums have pointed to strong investment and jewelry interest even at very high headline prices. Still, extreme volatility can briefly freeze real-world activity—buyers hesitate to chase a falling market, and dealers may widen spreads until the tape calms down.

If spot gold holds above the $5,000 region into the close, it could encourage dip-buying in physical channels. If it repeatedly breaks below and snaps back, the uncertainty itself can keep demand sidelined in the near term.

What traders are watching into February

The next catalysts are macro and policy signals: details around Warsh’s confirmation path and any fresh guidance that alters expectations for rates, inflation, or Fed independence. On the chart, traders are focused on whether gold can build a base above $5,000 after testing below it overnight. Volatility is likely to remain elevated; moves of this size tend to keep both buyers and sellers cautious.

For now, the key point is that Friday’s drop—while dramatic—follows an equally dramatic climb. The market is trying to decide whether this is a healthy reset after a parabolic move, or the start of a larger unwind tied to a new rates-and-dollar regime.

Sources consulted: Reuters; Associated Press; Barron’s; Investing.com; JM Bullion; Kitco