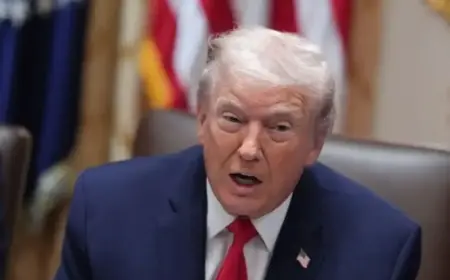

Wall Street Futures Recover as Trump Names Kevin Warsh Fed Chair

Recent market fluctuations have caught the attention of investors as Wall Street futures begin to recover. This change comes in light of President Donald Trump’s announcement of Kevin Warsh as his nominee for the Federal Reserve chair.

Market Reactions to Warsh’s Nomination

On Friday, Canada’s main stock index opened significantly lower. It was notably affected by commodity-linked shares. The drop was particularly pronounced after gold prices fell due to new leadership indicators from the U.S. Federal Reserve.

Impact on Canadian Stocks

At 09:31 a.m. ET, the S&P/TSX Composite Index recorded a decline of 1.53%, settling at 32,511.54 points. Shares in Bombardier, a key player in the Canadian market, dropped by 6%. This decline followed Trump’s warning about imposing a 50% tariff on Canadian aircraft sold in the United States.

U.S. Market Performance

The negative sentiment also permeated U.S. markets, with major indices opening lower. At 09:30 a.m. ET:

- The Dow Jones Industrial Average decreased by 146.89 points, or 0.32%, reaching 48,912.80.

- The S&P 500 fell by 23.24 points, equating to a 0.33% decline, settling at 6,945.77.

- The Nasdaq Composite dropped 107.88 points, or 0.43%, to 23,577.24.

Future Market Outlook

As traders assess the potential changes in monetary policy under Kevin Warsh’s leadership, the stock market’s trajectory remains uncertain. The reactions from both Canadian and U.S. markets highlight the interconnectedness of global finance.

Investors will continue to monitor Trump’s administration for further developments that may influence market conditions, especially regarding trade tariffs and economic policies.