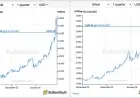

Gold Price Today Swings as Traders Weigh Dollar Strength, Rate Expectations, and a Growing “Risk Premium” Bid

Gold prices are trading with unusually sharp intraday swings today, with the market acting less like a sleepy store-of-value trade and more like a live, headline-sensitive hedge. The core pattern has been familiar: buyers step in when geopolitical or recession fears flare, then sellers hit the tape when the US dollar firms or Treasury yields tick higher—forcing gold to digest gains quickly rather than grind higher in a straight line.

The practical takeaway for anyone watching “gold price today” is that the direction is being set by macro cross-currents more than any single gold-specific headline. In the current environment, gold’s “why” changes faster than its “what.”

What Happened Today in Gold Markets

Gold has been choppy, moving in wide ranges as traders continuously reprice three things:

-

The US dollar’s tone (a stronger dollar tends to pressure dollar-priced gold)

-

The market’s view of interest rates (higher yields raise gold’s opportunity cost)

-

A fear premium that rises and falls with geopolitics, growth anxiety, and market stress

That mix creates a push-pull session where rallies can reverse quickly and dips can get bought just as fast—especially when traders are heavily positioned and quick to take profits.

Why Gold Moves With the US Dollar and Yields

Gold doesn’t pay interest. That single fact is the engine behind much of today’s volatility.

-

When Treasury yields rise, holding gold becomes less attractive because investors can earn more in interest-bearing assets.

-

When the dollar strengthens, gold often softens because it becomes more expensive for buyers using other currencies.

-

When yields fall or the dollar fades, gold tends to find support—particularly if the move is tied to weaker growth expectations or rising uncertainty.

A key nuance: gold often responds most to real yields (yields adjusted for inflation expectations). If traders believe inflation will stay sticky while growth cools, real yields can fall even if nominal yields look high—creating a constructive backdrop for gold.

The “Risk Premium” Story: Why Gold Can Rise Even When Rates Are High

Gold’s other role is psychological and strategic: it’s widely treated as portfolio insurance. That insurance value can increase when investors feel the world is becoming harder to model.

Today’s bid has been supported by risk themes that tend to pull money into defensive assets:

-

Geopolitical uncertainty and conflict escalation concerns

-

Worries about growth slowing or financial conditions tightening

-

Fragile confidence in “soft landing” narratives

-

Persistent inflation sensitivity tied to energy and supply-chain risks

This is why gold can rally at the same time that yields are uncomfortably high: in stress regimes, investors sometimes prioritize protection over carry.

Behind the Headline: Incentives, Stakeholders, and What the Market Is Really Pricing

Context matters. Gold is not trading in isolation; it’s sitting at the intersection of policy, politics, and positioning.

Incentives:

-

Short-term traders are incentivized to chase momentum and then cut risk quickly, which amplifies swings.

-

Long-term allocators are incentivized to hold gold as a hedge, but often wait to add on pullbacks rather than vertical moves.

-

Policymakers are incentivized to project stability, but markets price the possibility that stability can be disrupted—suddenly.

Stakeholders:

-

Central banks and reserve managers, whose buying or selling can shift demand quietly

-

Investors hedging equities and credit exposure

-

Jewelers and physical buyers, who feel price spikes immediately through reduced demand

-

Miners and refiners, whose margins and planning assumptions can change rapidly

Second-order effects:

When gold becomes this volatile, it can raise hedging costs, intensify swings in related metals, and make retail physical premiums feel more painful. It also changes the narrative around inflation and risk—even when the price action is driven mostly by positioning and sentiment.

What We Still Don’t Know Today

Several missing pieces will determine whether the next move is a renewed push higher or a deeper pullback:

-

Whether the dollar’s strength is a lasting trend or a temporary bounce

-

Whether rate expectations shift toward easier policy or “higher for longer”

-

Whether geopolitical risks intensify or cool enough to drain the fear premium

-

Whether demand is being driven by long-term accumulation or short-term trading flows

In other words, the market is still deciding whether gold is being bought as insurance or traded as momentum. That distinction will shape how durable any move becomes.

What Happens Next: 5 Realistic Scenarios and Triggers

-

Range-bound consolidation

Trigger: yields and the dollar stabilize, and gold digests recent volatility without fresh shocks. -

Another leg higher

Trigger: renewed risk-off pressure, weaker growth signals, or a drop in real yields. -

A sharper correction

Trigger: a sustained dollar rally, a rise in real yields, or broad risk markets turning calm and liquid. -

Whipsaw continues

Trigger: mixed economic signals and fast-moving headlines that keep traders flipping positions. -

A slow grind higher with pullbacks

Trigger: persistent uncertainty plus steady long-term buying, even as short-term traders take profits.

Why Gold Price Today Matters Beyond Gold

Gold’s action often functions like a sentiment gauge. When gold trades with outsized volatility, it’s a sign that investors are nervous about the reliability of other anchors—growth, policy, and geopolitical stability. The metal doesn’t just reflect fear; it reflects the price of uncertainty.