Lloyds to Distribute Billions After Surpassing Profit Forecasts

Lloyds Banking Group is poised to return over £3.1 billion to investors, as the bank showcases impressive profit growth. This marks a significant capital return for the largest domestic lender in Britain amidst a surge in profits.

Profit Performance and Capital Returns

Lloyds announced a pre-tax profit of £6.66 billion for the past year, an increase of 12% from 2024. This figure surpassed analysts’ expectations by £280 million. The strong results were supported by lower anticipated impairments for bad loans, recorded at £795 million, which were significantly better than the predicted £920 million.

Strategic Diversification and Income Growth

Under the leadership of CEO Charlie Nunn, Lloyds is diversifying its operations beyond traditional lending. The bank now focuses on fee-generating sectors such as wealth management and insurance. This strategy resulted in a 6% rise in underlying net interest income from lending, totaling £13.6 billion. Additionally, other income grew by 9%, reaching £6.1 billion.

Dividend and Share Buyback Plans

The robust financial performance enabled Lloyds to increase its final dividend to 2.43p per share, up from 2.11p the previous year. This adjustment equates to a £1.43 billion return for shareholders, which includes over 2 million retail investors. Furthermore, the bank plans a share buyback of up to £1.75 billion and has indicated the possibility of further capital returns in the future.

Future Expectations

Management has raised performance expectations for the upcoming year. Lloyds now anticipates a return on tangible equity exceeding 16% by 2026, an increase from the previous estimate of above 15%. Last year, the bank reported a 12.9% return, which had been slightly affected by an additional charge for a mis-selling scandal in the motor finance sector.

Impacts on Economic Outlook

Lloyds’ influence on the UK economy is significant, given its role as the country’s largest mortgage lender. The bank has revised its GDP growth prediction for this year to 1.2%, up from 1%. However, it has adjusted its unemployment forecast to 5.2%, compared to the initial 5% estimate.

Technological Advancements and Future Challenges

Charlie Nunn advocates for the adoption of artificial intelligence (AI) within the bank. Last year, the implementation of AI generated an estimated £50 million benefit through increased revenues and enhanced operational efficiency. While there are concerns regarding AI’s impact on employment in banking, Nunn acknowledged the uncertainty regarding its future effects on job markets.

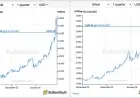

Market Reaction

At the close of trading on Thursday, Lloyds shares increased by 1p, or 0.9%, reaching 105.5p. This growth reflects investor confidence following the bank’s profitable outcomes and strategic initiatives.