Guide to Purchasing Gold in Canada

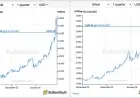

In recent months, the price of gold in Canada has reached unprecedented levels, effectively mirroring global economic uncertainties. The surge in value has attracted many investors eager to capitalize on this safe-haven asset.

Understanding Gold Prices in Canada

As of January 28, spot gold prices skyrocketed to US$5,300. This increase followed a significant milestone, where prices had already risen above US$5,000 just two days earlier. The ongoing political instability and shifts in economic conditions, particularly in the United States, play crucial roles in these price fluctuations.

Key Factors Influencing Gold Prices

- Geopolitical Tensions: Global events and political climates can significantly affect gold prices. For instance, past crises have seen gold prices rise dramatically, with an increase of 518 percent between July 1976 and February 1980.

- Weak U.S. Dollar: Gold is priced in U.S. dollars. A weakening dollar can make gold cheaper for international investors, stimulating demand.

- Central Bank Purchases: Many central banks are increasing their gold reserves, contributing to higher prices.

Investment Opportunities in Gold

Investors in Canada have various options to enter the gold market. Here are some methods:

- Physical Bullion: Buying gold in the form of bars, coins, or ingots. This can be done through banks, brokers, or even retailers like the Royal Canadian Mint.

- Exchange-Traded Funds (ETFs): These funds track the price of gold bullion, providing a convenient way to invest without holding physical gold.

- Mining Stocks: Investing in shares of mining companies can offer indirect exposure to gold prices, especially through index funds tracking the S&P/TSX Composite Index.

Market Predictions

Financial institutions like Deutsche Bank and Goldman Sachs are optimistic about future gold prices. Here are their projections:

- Deutsche Bank predicts gold may reach US$6,000 per ounce this year, with potential highs of US$6,900.

- Goldman Sachs anticipates a rise to US$5,400 by year-end.

- Morgan Stanley’s bull-case target stands at US$5,700.

- UBS has increased its price target to US$6,200 for 2026.

Despite these promising forecasts, investing in gold comes with inherent risks. Investors should assess their risk tolerance and conduct thorough research before making any decisions.

Whether you’re considering physical bullion or stocks, understanding the factors influencing gold prices in Canada will help you make informed investment choices.