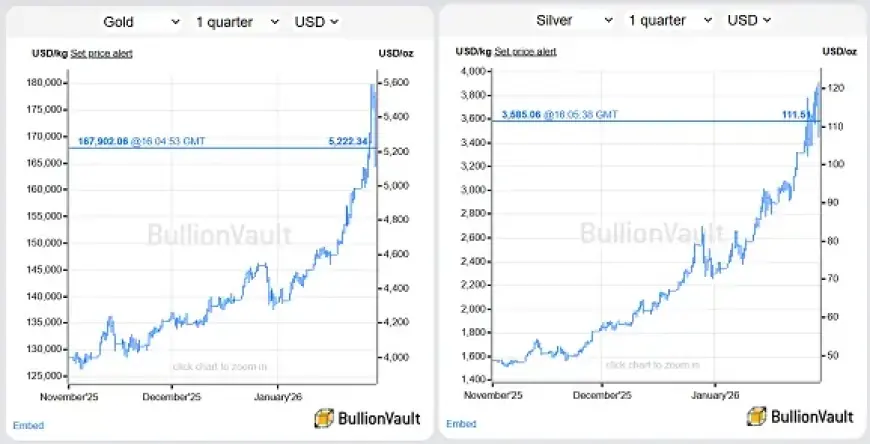

Gold Plummets $3.4 Trillion as Silver Falls 12% from Record High

The precious metals market is experiencing significant fluctuations, with gold prices dropping by an astonishing $3.4 trillion. This decline has been mirrored by a notable 12% decrease in silver values from their record highs.

Gold and Silver Market Overview

Gold and silver are two of the most sought-after precious metals, frequently viewed as safe-haven investments. Recently, both have seen unprecedented changes in their market valuations.

Gold’s Significant Decline

The value of gold has plummeted drastically, affecting global markets. Investors are closely monitoring this downturn, which reflects broader economic trends. The total decline in gold’s market is estimated at $3.4 trillion.

Silver Prices Drop

Alongside gold, silver has also suffered significant losses. It has declined by 12% from its previous record high. This drop raises concerns among investors about the future stability of precious metals.

Economic Implications

The fall in gold and silver prices can result in wide-ranging economic effects. Here are some potential implications:

- Increased volatility in investment portfolios.

- Shift in investor confidence towards alternative assets.

- Impact on mining companies and related industries.

Conclusion

The recent declines in gold and silver prices signify a critical moment for investors. As the market adjusts, stakeholders should remain vigilant about trends in precious metals. Monitoring these changes will be essential for informed investment decisions.