Wordle’s daily habit powers a bigger push into multiplayer word games

Wordle is still the one-a-day ritual that many players build mornings around, but late January 2026 shows how far the game’s influence now stretches beyond a single five-letter puzzle. The company that operates Wordle has rolled out a new two-player word game called Crossplay, a move that leans on Wordle’s viral-era momentum while nudging its broader games business into more social, competitive territory.

In 2025, the company’s games lineup was played more than 11.2 billion times, with Wordle alone accounting for 4.2 billion plays. That scale helps explain why Wordle remains the anchor: it drives repeat visits, keeps the broader puzzle ecosystem top of mind, and supports a subscription-style bundle where games sit alongside other digital products.

Crossplay lands as Wordle stays the engine

Crossplay is positioned as a modern, mobile-friendly twist on classic tile-based word games, designed for head-to-head play rather than solo solving. It uses a 15 by 15 board and turn-based scoring, and players can challenge friends, face matched opponents, or play against a computer. A built-in postgame analysis tool, branded as Cross Bot, is meant to show where a player gained or left points, echoing the feedback culture that helped Wordle turn into a daily shareable habit.

The release matters because it signals confidence that Wordle has matured from a breakout hit into a reliable foundation. Instead of chasing nonstop engagement, the strategy appears to prioritize consistency and routine: Wordle sets the pace, and adjacent games broaden the audience without forcing players into marathon sessions.

Some specifics have not been publicly clarified, including how Crossplay’s long-term monetization will differ for free users versus paying subscribers.

Why multiplayer is a different challenge than a one-a-day puzzle

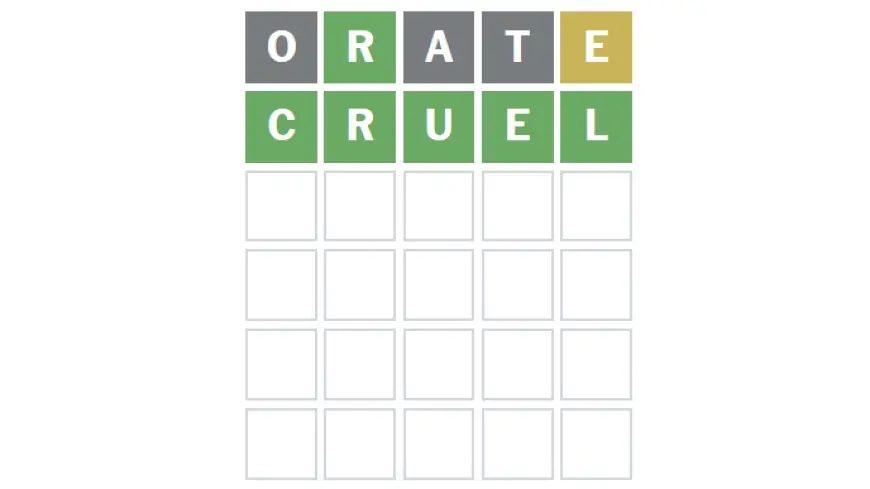

Wordle’s design is intentionally simple: one puzzle per day, a small set of rules, and instant feedback that makes the game easy to learn and hard to quit. Players guess a five-letter word in up to six tries, using colored tile feedback to show which letters are correct, misplaced, or absent. That cadence does more than make Wordle approachable; it limits fatigue, encourages returning tomorrow, and turns performance into a low-stakes daily benchmark.

Multiplayer introduces a different kind of complexity. Two-player games require matchmaking, identity and friend systems, anti-cheat protections, and the ability to handle asynchronous turns and messaging without breaking the experience. Crossplay also adds more “live” variables, like opponent behavior and pacing, which means the product has to be resilient in a way Wordle never needed to be.

A full public timeline has not been released detailing what feature additions Crossplay will prioritize first after launch.

A business built on habits, not hours

The broader bet is that word games can be a stable, repeatable business built on short daily visits rather than endless scrolling. Wordle’s most enduring innovation may be behavioral, not technical: it encourages a healthy routine with a clear finish line. That rhythm can support a larger library of puzzles and games that feel complementary rather than overwhelming, while keeping standards high and pruning ideas that do not resonate.

Crossplay also hints at a longer arc. Wordle proved that a lightweight daily challenge can become a global conversation. Crossplay aims to convert that same audience into friendly rivalry, longer arcs of progress, and deeper retention through social ties rather than simply raising the difficulty of the puzzle.

What it means for players, creators, and rivals

Players are the first group affected. Daily Wordle solvers may treat Crossplay as an optional second act, but competitive word-game fans could see it as a primary destination, especially if the experience stays clean and focused. The second group is the wider community of puzzle creators and small game developers. Wordle’s rise demonstrated how a simple concept can explode through shareability, but it also raised the bar for polish, reliability, and long-term product stewardship once a game hits mass scale.

There is also an impact on competing word games and casual gaming apps, which now face a stronger challenge from a brand that already owns a daily place in many people’s routines. If Crossplay earns even a fraction of Wordle’s habitual audience, it could reshape what “casual” success looks like in word games, shifting expectations toward fewer ads, clearer design, and stronger analysis tools.

Looking ahead, the next concrete milestone will be the company’s next quarterly earnings report and product update cycle, where subscriber totals, engagement trends, and early signals from Crossplay’s rollout are likely to be reflected in the metrics it chooses to share.