Gold Price Today: Bullion Breaks Above $5,300 as Markets Brace for the Fed

Gold Price Today is defined by another record-setting surge, with the metal pushing into the mid-$5,000s per ounce and briefly topping $5,300 during Wednesday’s trade, Jan. 28, 2026. The jump is keeping gold at the center of global risk positioning as investors weigh a softer dollar, shifting expectations for U.S. interest rates, and broader unease about the policy backdrop.

A live spot quote around 7:44 a.m. ET showed gold near $5,284.78 per ounce, or about $169.91 per gram, after an early push to fresh highs.

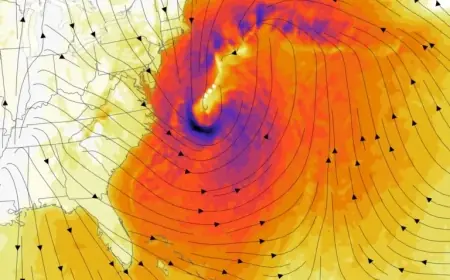

Record levels follow a sharp move in the dollar

Gold’s latest rally has been powered by a familiar combination: a weaker U.S. dollar and an intensifying demand for assets viewed as defensive in uncertain periods. When the dollar falls, dollar-priced gold tends to look cheaper to many non-U.S. buyers, often boosting demand at the margin.

Traders also watched gold ride the momentum from earlier sessions, when the metal logged an outsized gain and carried that strength into Wednesday. The speed of the move matters as much as the level. Fast rallies can pull in both longer-term buyers looking for protection and shorter-term traders trying to catch a trend, which can amplify daily swings.

Further specifics were not immediately available on the exact mix of today’s demand between physical buying, derivatives positioning, and institutional reallocations. A full public breakdown of same-day physical bullion flows has not been released.

How gold pricing works and why rates matter so much

Gold is priced continuously through a blend of spot trading and futures markets, with arbitrage linking the two. Spot reflects the immediate price for delivery, while futures reflect expectations for delivery at a later date, adjusted for funding costs, storage, and market positioning. In plain terms, when large pools of capital shift toward buying futures, spot often follows as dealers and market makers hedge exposure.

Interest rates and the dollar sit at the center of the mechanism. Gold does not pay interest, so it competes against cash and bonds. When investors expect rates to stay steady or fall, the opportunity cost of holding gold can look smaller, making bullion more attractive. Inflation expectations also play a role: if investors worry that purchasing power will erode, they sometimes increase exposure to hard assets as a hedge, even if the relationship is not perfect day to day.

Volatility is another accelerant. When risk appetite drops, some investors rotate into gold to reduce portfolio swings. When volatility rises too far, others sell what they can to raise cash, which can briefly pressure gold as well. That is why large daily moves can happen in either direction even when the long-term narrative sounds steady.

Who feels higher prices first: households, dealers, and industry

Two groups are impacted immediately: jewelry buyers and bullion investors. For households shopping for jewelry, the practical effect is straightforward: retail prices often rise, promotions become more selective, and consumers may trade down in weight or purity to stay within budget. For coin and bar investors, higher spot prices can mean wider attention and heavier trading volume, but also larger bid-ask spreads and more price sensitivity when the market whipsaws.

A second set of stakeholders includes refiners and manufacturers that use gold in electronics and specialized industrial applications. Higher input costs can squeeze margins, push firms to hedge more aggressively, or encourage substitution where possible. Miners can benefit from stronger realized prices, but they also face cost pressures and the challenge of sustaining production, which means profitability is not just a function of headline gold prices.

Internationally, currency moves can magnify the effect. In countries where local currencies weaken against the dollar, gold can rise even faster in local terms, influencing both consumer demand and investment behavior.

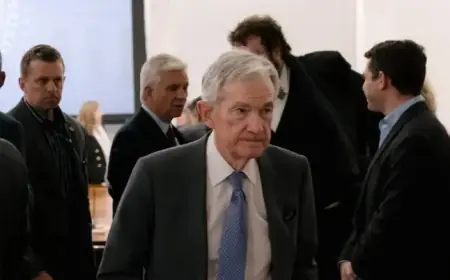

The next milestone is policy clarity later today

The market’s next major checkpoint arrives Wednesday afternoon, when the Federal Reserve is scheduled to release its policy statement at 2:00 p.m. ET, followed by a press conference at 2:30 p.m. ET. Even if the policy rate is unchanged, traders will listen for guidance on the balance between inflation risks and growth concerns, as well as how officials describe financial conditions.

Some specifics have not been publicly clarified about how much of today’s gold move is tied to longer-term buying versus short-term positioning ahead of the Fed. What happens after the decision will likely come down to whether policymakers sound more comfortable holding rates steady, or whether they leave the door open to a different path later in 2026.

For now, gold’s message is simple: markets are paying up for protection, and they are doing it at record prices.