2026 Investment Strategy: Align with White House Policies

The new investment landscape in 2026 is heavily influenced by recent actions and announcements from the White House. President Trump’s policies are notably affecting the stock market and altering traditional investment strategies.

2026 Investment Strategy: Align with White House Policies

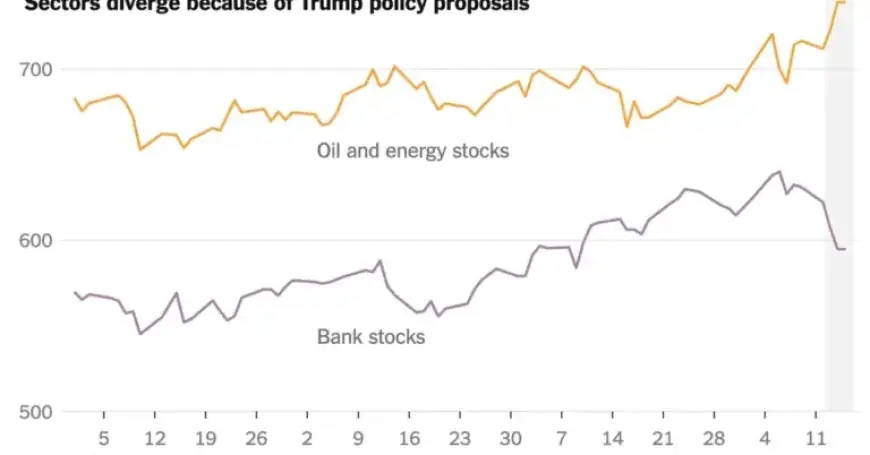

The U.S. military’s actions in Venezuela have led to a surge in certain oil stocks. Trump announced plans to sell 30 to 50 million barrels of Venezuelan oil, claiming it would benefit both Venezuela and the United States. This statement galvanized the energy sector, particularly due to rising investor confidence.

Despite concerns about returning to Venezuela post-conflict, companies such as SLB and Halliburton are witnessing significant gains. SLB’s stock has increased over 20 percent, while Halliburton is up 15 percent. Additionally, major oil players like Chevron and Exxon Mobil have risen around 10 percent this year.

Market Reactions to White House Announcements

- Oil prices have risen slightly above $60 per barrel, yet this is not high enough to prompt considerable investments in new drilling.

- Trump’s proposal to impose a 10 percent cap on credit card interest rates has unsettled banking stocks, with major banks declining over 5 percent as a result.

- Despite the fluctuations, the S&P 500 index has only seen a modest rise of 1 percent this year.

Analysts express surprise at the volatility, noting that Trump’s influence on market dynamics deviates from past beliefs that other factors, like Federal Reserve policies, held greater sway. Hardika Singh from Fundstrat observed that the mantra may be shifting from “Don’t fight the Fed” to “Don’t fight the White House.” This changing perspective indicates a growing recognition of the president’s role in steering market behaviors.

Persistent Challenges Ahead

As the midterm elections approach, economic policies that adversely affect growth could be abandoned swiftly. Parag Thatte from Deutsche Bank emphasizes that Trump’s approval rating aligns closely with consumer confidence. Therefore, any detrimental policy could return to haunt his administration.

Rob Arnott, founder of Research Affiliates, also cautions that while initiatives may aim to narrow wealth inequality, they risk failing to achieve their intended outcomes. Pressure is mounting on the administration to balance its political strategies with market stability, especially as economic indicators remain sensitive during this pivotal election year.

In summary, aligning investment strategies with White House policies in 2026 could prove essential as the market responds to President Trump’s evolving agenda. As investors navigate these complexities, understanding the implications of these actions will be critical to making informed decisions.