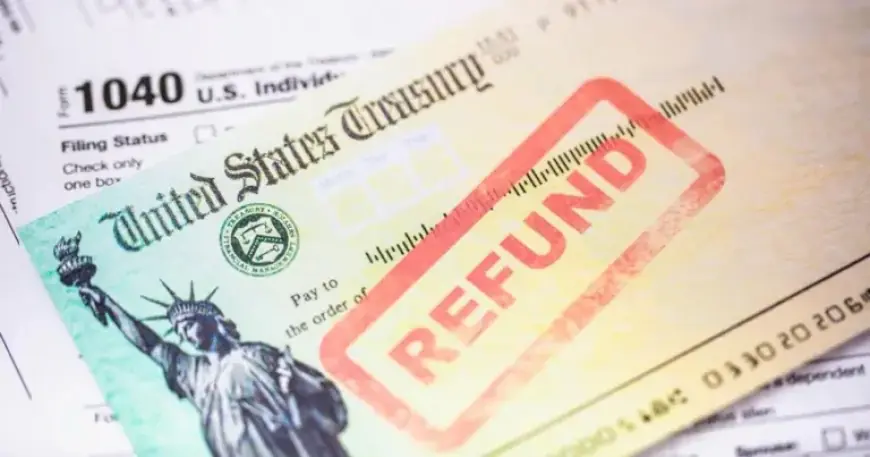

$6,000 Senior Tax Deduction Set to Impact Millions of Americans Over 65

A new tax deduction of $6,000 for Americans aged 65 and older is poised to provide significant financial relief. This benefit could add approximately $670 to the tax refunds of millions of seniors in the upcoming tax season. Advocacy group AARP believes that certain individuals, particularly those in the 22% tax bracket, may see even higher savings.

$6,000 Senior Tax Deduction: A Closer Look

The $6,000 deduction is part of legislation introduced by Republican lawmakers, termed the “big, beautiful bill” act. According to AARP officials, this deduction will be available through 2028, offering four years of relief for older Americans dealing with rising living costs.

Potential Savings

Taxpayers earning between $44,000 and the income cap of $75,000 could benefit substantially. AARP’s Bill Sweeney highlighted the significance of this deduction, noting it could provide up to $1,320 in savings for eligible individuals.

Eligibility for the Deduction

- Individuals must be at least 65 years old by December 31, 2025.

- Single filers can claim the full $6,000 deduction if they earned less than $75,000 in the previous year.

- Married couples may qualify for $12,000 if their combined income is below $175,000.

- The deduction phases out at $175,000 for single filers and $250,000 for married couples.

- Qualifying individuals must possess a work-authorized Social Security number.

Other Tax Benefits

The new deduction complements existing tax breaks for seniors, including a $2,000 deduction. This means that seniors can combine the new deduction with the standard deduction. The current standard deductions are:

- Single filers: $15,750

- Married couples filing jointly: $31,500

When combined, single filers over 65 can deduct up to $23,750, while married couples can deduct as much as $46,700.

Impact on Social Security Income

While this deduction can lower taxable income, it does not exempt Social Security benefits from taxation. However, seniors can use the deduction to reduce overall taxable income, effectively shielding more of their earnings from federal taxes.

Many seniors may remain unaware of this tax break, making outreach critical. The IRS will accept tax filings starting January 26, 2025. For older Americans concerned about meeting their financial needs, this deduction represents a meaningful opportunity for relief.