Lloyds to Shut Two Oxfordshire Branches by June

Lloyds Banking Group has announced the closure of two branches in Oxfordshire, marking significant changes in the local banking landscape. The branch located at Market Place in Didcot will close on June 24, while the South Newington branch will shut down earlier on June 10. This decision aligns with the bank’s strategy to transform its operational framework across the region.

Lloyds Branch Closures and Community Impact

These closures are part of a broader plan to shut down 53 Lloyds, 31 Halifax, and 11 Bank of Scotland locations. After the closures, only 610 branches will remain under the Lloyds brand.

Following the Didcot branch’s closure, residents will have to travel to Cowley, Oxford city center, or Newbury for their nearest Lloyds services. Currently, Didcot will have a Barclays bank and two building societies as alternatives.

New Banking Solutions for Didcot

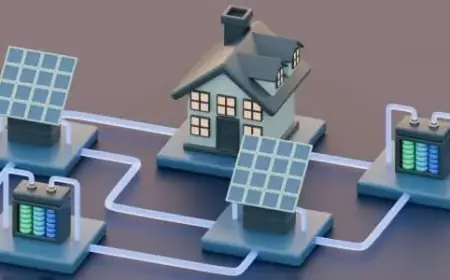

In response to these closures, the ATM network LINK plans to introduce a banking hub in Didcot. Banking hubs offer shared services, allowing customers to withdraw and deposit cash, and pay bills, managed by staff from various banks on different days.

- Closing Dates:

- Didcot: June 24

- South Newington: June 10

- Nearest Alternatives:

- Cowley

- Oxford City Centre

- Newbury

Community Reactions

Chris Ashton, chief commercial officer of LINK, emphasized the importance of cash services, stating that while digital banking is on the rise, many customers still depend on cash transactions. He expressed optimism about the new hub enhancing community banking.

Locally, Didcot councillor Ian Snowdon expressed concern over the bank closures. He acknowledged the importance of the banking hub but highlighted the need for it to genuinely address local needs, particularly for older and vulnerable customers.

The banking landscape in Didcot is evolving, and with the forthcoming banking hub, residents may find new solutions to meet their financial needs amid the transition. As these changes unfold, the focus remains on providing flexibility and accessibility for all customers.