Ford and GM Compete with Tesla in Energy Storage Innovation

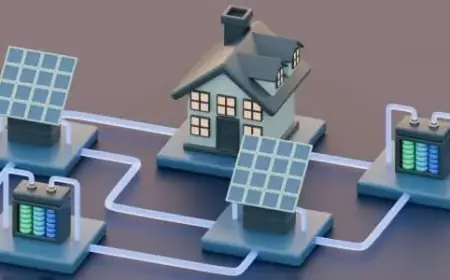

Ford and General Motors (GM) are advancing their interests in energy storage, a move aimed at competing with Tesla. Both companies are planning expansions that could influence electric vehicle (EV) manufacturing costs and depend less on foreign imports.

Market Dynamics and Energy Storage Demand

The U.S. EV market is experiencing slower growth than anticipated. This slowdown is attributed to policy changes initiated during the Trump administration, which relaxed restrictions on internal combustion engine (ICE) vehicles. Consequently, automakers have reduced their EV production targets in response to dwindling demand.

Despite lower EV sales, the need for battery storage solutions is on the rise. The renewable energy sector has recently increased its capacity, prompting energy companies to explore utility-scale storage systems for improved reliability.

Growth of the Energy Storage Market

According to market research, the global battery energy storage system market is projected to reach $14.5 billion by 2027. This market is expected to grow at a compound annual growth rate (CAGR) of 25.2 percent from 2021 to 2027. The technology used in energy storage systems closely resembles that used in EV batteries, presenting a promising opportunity for automakers.

Tesla’s Leadership and Impact

Tesla has set a precedent in the energy storage domain, having developed several giga-factories globally. In 2020, the company achieved over three gigawatt-hours (GWh) in energy storage deployments, primarily through its Megapack. Tesla Energy also reported a year-on-year capacity increase of 84 percent, accumulating 43.5 GWh.

Revenue from Tesla’s energy storage segment reached $3.41 billion, showcasing the potential profitability of this sector. This success has motivated other automakers to join the energy storage business.

Ford’s Strategic Initiatives

- Ford plans to convert its Kentucky battery production plant to focus on energy storage batteries.

- The automaker aims to cater to the increasing demand from data centers and utilities.

- In Marshall, Michigan, Ford will also produce residential storage cells alongside EV batteries.

Ford has invested around $10 billion in these projects, with an additional $2 billion earmarked for future energy operations. This shift indicates a strategic pivot towards hybrids, trucks, and energy storage, particularly after a substantial write-down of $19.5 billion related to EV ventures.

GM’s Energy Business Expansion

- GM Energy was established to enhance GM’s presence in the energy market.

- The company plans to collaborate with Redwood Materials for EV battery storage solutions by 2025.

- GM saw a fivefold increase in sales from January to October last year.

One of GM’s notable products is the “PowerBank,” introduced in 2024, with options of 10.6 kWh and 17.7 kWh capacities. This product enables EV owners to store and manage solar energy effectively.

Future Outlook

As the EV sales forecast in the United States becomes increasingly uncertain, automakers like Ford and GM are diversifying their business models. By investing in energy storage, they not only safeguard their existing manufacturing capabilities but also broaden their market appeal, addressing growing opportunities in utilities and large-scale data centers.

Both companies are following Tesla’s lead by heavily investing in energy storage, ensuring their relevance in an evolving industry landscape.