US Stocks Plunge: Dow Jones, S&P 500, Nasdaq Tumble for Second Day

The U.S. stock market experienced significant declines for the second consecutive day, with substantial losses across major indices. Key metrics showed that the Dow Jones Industrial Average fell by 267.77 points, closing at 49,184.21, a decrease of 0.54%. The S&P 500 also slid down 26.54 points to 6,806.22, representing a decline of 0.39%. The Nasdaq Composite faced a loss of 159.11 points, ending the day at 22,438.04, which is a drop of 0.70%.

Market Reactions to Inflation Data

This market sell-off occurred despite newly released inflation data indicating a cooling trend. According to the Bureau of Labor Statistics, the Consumer Price Index (CPI) rose only 0.2% month-over-month and 2.4% year-over-year in January, falling below the annual estimate of 2.5%. This marks a decrease from the September peak of over 3% and December’s 2.7% figure.

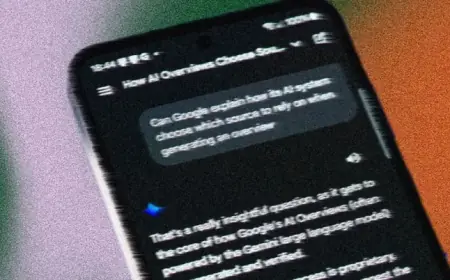

Investor Concerns Over AI Disruption

Despite lower inflation figures, Wall Street remains cautious. Investors are increasingly worried about the potential impact of artificial intelligence (AI) disruption beyond technology stocks, affecting sectors such as real estate, logistics, and trucking. This growing apprehension is heightened by renewed speculation about possible interest rate cuts by the Federal Reserve.

Federal Reserve Rate Cut Expectations

The January CPI report has altered trader expectations, with a quarter-point rate cut now anticipated for June. Overall, markets are factoring in at least two additional cuts by late 2026. However, the Federal Reserve is proceeding with caution, balancing inflation progress against a strong labor market, which could lead to volatile market conditions.

Market Activity and Stock Performance

Technology stocks suffered heavily, with all seven of the renowned “Magnificent Seven” companies experiencing declines. For instance:

- NVIDIA dropped 1.64% to $186.94.

- Apple fell by 5% to $261.73.

- Amazon slid 2.20% to $199.60.

- Intel decreased by 3.75% to $46.48.

This downward trend reflects a broader fear that while some companies may benefit from AI, others might not keep pace.

Sector Performance and Notable Gains

Despite the sell-off, there were standout performers in the market. Fastly, Inc. (FSLY) surged by over 72% after exceeding revenue expectations with a report showing a 23% increase. Other noteworthy performers included:

- Rivian (RIVN) rose more than 25% due to strong delivery forecasts.

- Applied Materials (AMAT) climbed 13%, buoyed by optimistic second-quarter guidance.

- Airbnb (ABNB) and Moderna (MRNA) both saw gains of 6% following positive earnings reports.

Commodity Markets Respond to Uncertainty

As equities fell, safe-haven assets gained traction. Gold prices increased by 1.60% to $5,027.70, while silver surged by 3.77% to $78.53. This shift reflects investor sentiment that favors security amid market volatility.

Conclusion: Navigating Market Volatility

Heavy trading in leveraged exchange-traded funds (ETFs) indicates aggressive market positioning. With fluctuating inflation rates and dues on consumer behavior, the future trajectory of the market remains uncertain. Traders are closely monitoring developments to assess sustainability and stability in economic growth.