Ontario Retirement Plans Transform Amid Affordability Concerns

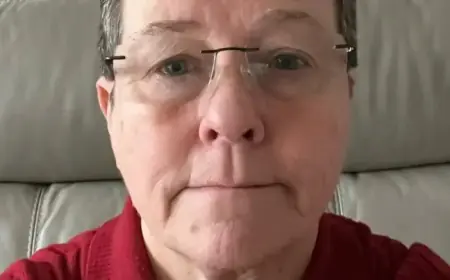

As retirement plans in Ontario face mounting affordability challenges, many retirees are reassessing their financial stability. Residents like Dave Scott, aged 69, epitomize this struggle. He and his wife live mortgage-free in Peterborough, Ontario, relying on a monthly income of approximately $5,000. Despite their seemingly stable financial status, they find it increasingly difficult to maintain their quality of life due to rising living costs.

Concerns About Affordability in Retirement

Scott’s situation reflects a common sentiment in Ontario. Recent surveys reveal that 66% of Ontarians prioritize enjoying retirement fully by 2026, the highest percentage in Canada. Meanwhile, a significant 36% of Canadians report that financial insecurity adversely affects their mental health.

The Reality of Lower Retirement Income

Once earning a combined household income of roughly $130,000, Scott and his wife now must adapt to a reduced budget in retirement. They are facing sacrifices, particularly in their grocery shopping, where rising prices prompt them to eliminate purchases like red meat. Scott describes their situation as being “stuck in the middle,” balancing between affluent retirees and those struggling to make ends meet.

- Retirement income instability affects peace of mind.

- Cost of living increases force retirees to cut back on everyday expenses.

- Many face challenges in fulfilling their financial expectations for retirement.

Working Longer and Cutting Expenses

Experts, such as Doug Hoyes, a licensed insolvency trustee, suggest that retirees should prioritize limiting expenses. He notes that many seniors are working longer or significantly reducing their discretionary spending to manage their finances. Many retirees are even foregoing small luxuries to help balance their budgets.

For many like Scott, there is concern for future generations. As he puts it, the question of what it means to be middle-class has become increasingly complex.

The Broader Financial Picture in Ontario

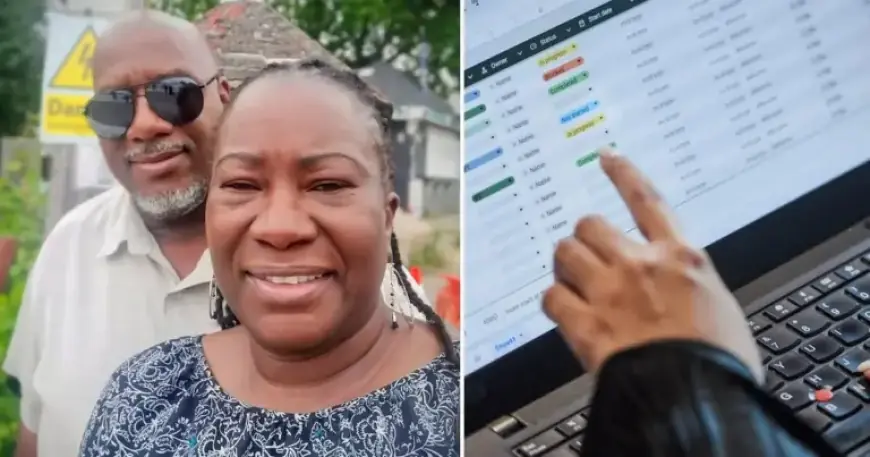

Younger workers also share these affordability concerns. Carol Johnson, 56, exemplifies this struggle. Living in Hamilton, she earns about $70,000 annually and has recently transitioned from renting to homeownership. However, the move has burdened her finances, especially since she is the sole income provider after her husband fell ill during the pandemic.

Debt and Financial Strain

Johnson reports feeling overwhelmed as she navigates her new financial reality. A significant portion of her budget goes towards covering moving expenses, often using credit to make ends meet. She indicates that making ends meet has required considerable sacrifices, including relying on food banks.

- Over a million Ontarians accessed food banks between April 2024 and March 2025.

- This figure indicates an 87% increase compared to 2019-2020.

Changing Definitions of Financial Security

Experts emphasize that financial stability is no longer defined solely by age. Hoyes points out that many individuals aged 45 to 55 are particularly vulnerable, as they juggle responsibilities such as supporting both children and aging parents. The rising cost of living and insufficient income may force some to consider downsizing or renting as viable options for long-term financial security.

Ultimately, as both young and older Ontarians face these challenges, the need for a proactive approach in managing retirement plans becomes ever more critical. For individuals like Scott, maintaining peace of mind amid uncertain economic times remains a top priority.