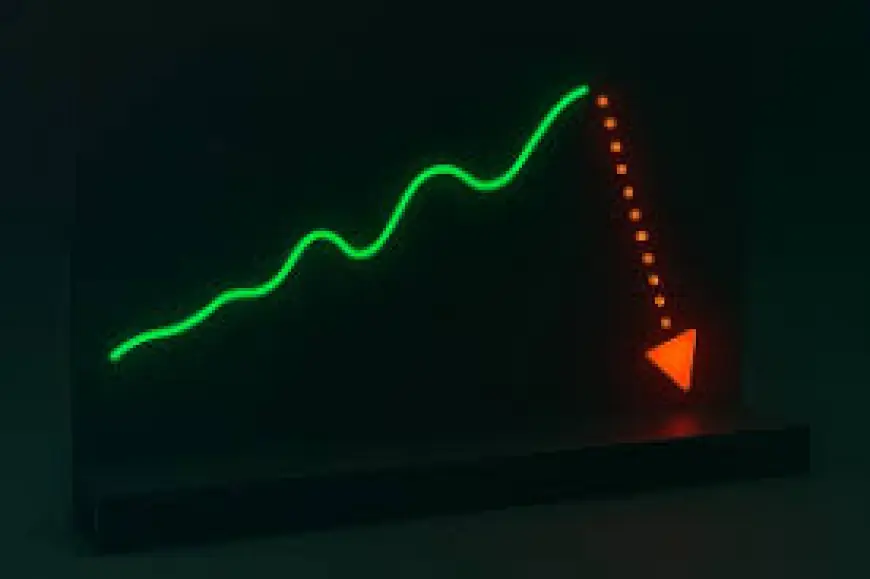

Bright Horizons Shares Tumble as 2026 Outlook and Portfolio Moves Rattle Investors

Shares of Bright Horizons slid sharply on Feb. 15, 2026 ET, extending recent volatility as investors reacted to a weaker-than-expected 2026 financial outlook and questions around portfolio rationalization. The drop has rekindled debate over whether the decline is a transient pullback or a sign of deeper operational headwinds.

What triggered the sharp sell-off?

Market attention focused on a combination of factors that converged to push the stock down more than 18% in a single session. Management’s guidance for 2026 fell short of investor expectations, heightening skepticism about near-term revenue growth and margin recovery. At the same time, the company’s plans to reshape parts of its portfolio introduced additional execution risk — investors worry that disposals, closures or strategic shifts could weigh on cash flow during a sensitive period for demand.

Valuation metrics currently characterize the shares as roughly fair, reflecting a balance between moderate operational performance and risks tied to the outlook. Still, abrupt downward moves like this tend to prompt a reassessment of key assumptions: enrollment trends in childcare centers, corporate demand for back-to-work child care solutions, and the pace of cost rationalization that management can realistically achieve over the next 12–18 months.

How resilient is the stock if markets slip further?

A central question for investors now is how the shares will behave if broader markets deteriorate. Using a simple stress scenario — another 20% to 30% decline that would place the stock near the mid-$40s — historical patterns suggest this name has been more volatile than the broader index in prior downturns and typically takes longer to recover. That combination of deeper drawdowns and slower rebounds can amplify losses for concentrated holders.

Investment professionals warn that cyclicality and company-specific execution risk make downside protection an important consideration. If the stock drifts toward the hypothetical mid-$40s range, existing shareholders should reassess position sizing within diversified portfolios, consider dollar-cost averaging only if confidence in the long-term thesis remains intact, and evaluate whether balance-sheet flexibility and free cash flow projections justify holding through a prolonged recovery window.

For investors who prioritize capital preservation, options include trimming exposure, rebalancing into less-correlated assets, or shifting a portion of the allocation into income-generating holdings until clarity on the 2026 outlook improves. Conversely, long-term investors who view the pullback as an opportunity will want explicit evidence that enrollment and margin metrics are stabilizing before adding incrementally.

Outlook and practical next steps for investors

Near-term catalysts to monitor include upcoming quarterly results that reveal early signs of enrollment momentum or cost-savings progress, management commentary on the timeline and expected proceeds from any portfolio rationalization, and broader macro indicators tied to employment and corporate spending on child-care benefits. Any indication that the company can reaccelerate revenue while protecting margins would reduce downside risk and support a case for recovery.

In the current environment, a disciplined portfolio approach is essential. Investors should align position size with risk tolerance, set clear stop-loss or re-evaluation points, and avoid reacting solely to single-session volatility. Whether the recent decline marks a buying opportunity or the start of a longer correction will depend on a mix of execution from the company and the trajectory of the broader market in the months ahead.