2025 Q4 and Annual Results: Key Insights and Updates

The financial landscape of BP is constantly evolving, and significant updates have emerged for the fourth quarter of 2025. These insights outline BP’s expectations and operational adjustments for the year ahead.

2025 Q4 and Annual Results: Key Insights

Forecasts and Projections

BP has highlighted several projections regarding its future financial performance and operational strategy. Key areas of focus include:

- Oil and Gas Demand: Predictions concerning the supply and pricing volatility of oil and gas.

- Production Volumes: Expectations on production output and related maintenance activities.

- Financial Health: Insights into BP’s balance sheet, cash flows, and shareholder returns.

- Dividends and Share Buybacks: Plans regarding dividends, share repurchase strategies, and how excess cash will be utilized.

Operational Expectations

BP’s outlook also includes specific operational initiatives, such as:

- Capital expenditures related to new projects and investment strategies.

- Plans for divestments, particularly concerning the Castrol business and selected assets like the Gelsenkirchen refinery.

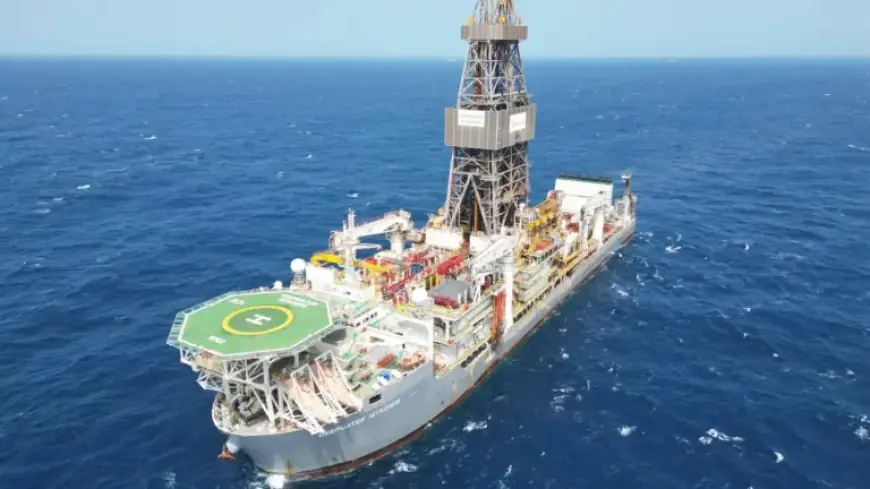

- Upcoming projects, including the Greater Western Flank 4 and the Atlantis Drill Center 1 expansion.

External Risks and Uncertainties

While BP’s outlook presents optimistic forecasts, several uncertainties may impact actual outcomes:

- Volatility in commodity markets and oil prices.

- Global economic conditions and consumer preferences.

- Regulatory changes and the pace of alternative energy adoption.

- Political instability and economic dynamics within various regions.

BP acknowledges that these external factors can significantly alter its trajectory. As a result, the company’s strategies will adapt to navigate this complex environment.

Industry Developments

Further influencing BP’s strategy are developments in technology and operational practices. The company is focusing on:

- Reducing operational costs and enhancing productivity.

- Embracing new technologies to maintain competitive advantages.

- Meeting evolving market demands and regulatory expectations, particularly related to climate change.

Conclusion

As BP prepares for the final quarter of 2025, the emphasis is on adaptability in the face of uncertainty. The evolving energy landscape will require careful navigation of risks and opportunities. Stakeholders will monitor these developments closely to gauge BP’s response and performance.