ChatGPT App Emergence Drops Broker Share Prices

The emergence of ChatGPT-powered insurance applications has raised alarms about the potential long-term effects of artificial intelligence on insurance brokers and the industry as a whole. The launch of such apps is significantly altering how consumers interact with insurance services, thus impacting major brokerage firms.

ChatGPT App Impacts Broker Share Prices

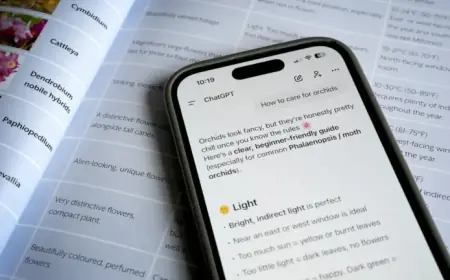

Insurify, a prominent online insurance comparison platform based in the United States, recently announced its launch of a ChatGPT app. This application facilitates the research and comparison of motor insurance quotes for users.

In a parallel development, Spanish insurtech company Tuio has introduced its own AI-driven insurance app. This app, approved by OpenAI, allows users to receive personalized home insurance quotes directly through ChatGPT. Tuio asserts that this marks a significant milestone in the insurance purchasing journey, offering a streamlined experience devoid of lengthy forms or phone calls.

As these apps gain traction, major brokerage firms such as WTW and Gallagher have witnessed a sharp decline in their share prices. Investors are expressing concern regarding the role of brokers as intermediaries in light of these technological advancements. Notably, Steadfast and AUB have also experienced losses, with stock prices falling by 6% and 10%, respectively. The impact has extended to insurers like IAG, Suncorp, and QBE, as investors consider the potential effects on the insurance sector.

Industry Reactions and Analyst Insights

Morningstar analyst Nathan Zaia noted that the ChatGPT applications are directly linked to the current sell-off in shares. He emphasized that while there are uncertainties regarding the accuracy of information provided by these AI models, the potential for brokers to lose business is still a topic of debate.

“It’s premature to conclude that brokers will face significant loss of business due to these apps,” Zaia stated. “This response is a preliminary indication of how the market perceives these developments.”

Future of Broking in the Age of AI

Equity analysts at Jarden have offered insights into how brokers may cope with this AI disruption. They predict that the greatest risk will likely be in the retail broking segment, which is more susceptible due to standardized products and price-driven purchase decisions.

- Steadfast is estimated to have about 35% of earnings at risk from AI disruption.

- AUB faces a potential 16% at-risk earnings estimate.

These figures are seen as theoretical and represent earnings that could be at risk over the next five years. Jarden cautions that this does not signify immediate earnings loss, as brokers still have strengths that could mitigate the impact of AI technologies.

In summary, while the introduction of ChatGPT-powered insurance apps has led to immediate market reactions, the long-term effects on brokers and the insurance industry remain to be fully understood. Ongoing analysis and adaptation will be crucial as the landscape evolves.