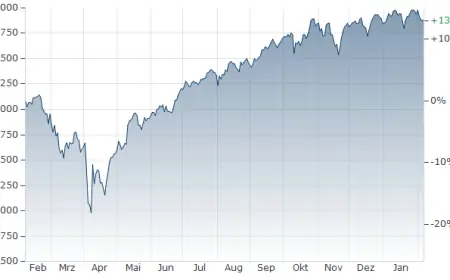

Bitcoin price slides as crypto selloff deepens, with forced deleveraging in focus

Bitcoin fell again Friday as a broad risk-off wave swept through crypto markets, extending a sharp drawdown that has dominated early 2026. The latest leg lower has been driven less by a single headline and more by a familiar mix of leverage getting unwound, investor appetite cooling, and money rotating away from volatile assets.

As of 9:33 a.m. ET, bitcoin was $67,205, down about 4% from the prior close after a volatile overnight swing that briefly pushed prices near the low-$60,000s.

| Snapshot | Level |

|---|---|

| BTC price (as of 9:33 a.m. ET) | $67,205 |

| Change vs. prior close (approx.) | -4% |

| Intraday high (approx.) | $70,572 |

| Intraday low (approx.) | $60,297 |

Bitcoin price today in USD: what’s happening now

The move has been choppy, with steep drops followed by quick rebounds—classic behavior when liquidations and margin calls hit a market with heavy derivatives positioning. Even when bitcoin bounces, the bigger story has been the pace of the decline from the late-2025 peak, which has left traders focused on whether the market is stabilizing or still searching for a bottom.

That volatility is also spilling into the rest of crypto. Large-cap tokens have tracked bitcoin’s swings, and thinner markets have tended to move more violently, amplifying the sense of a “crypto crashing” day when screens turn red across the board.

Why is bitcoin dropping, and why is crypto crashing?

Several forces have lined up at once:

Forced deleveraging. A rapid down move can trigger cascading liquidations in leveraged futures and perpetual swap markets. When positions are forcibly closed, they become automatic sell orders (or buy orders on shorts), which can intensify momentum in either direction—especially in thinner liquidity windows.

Risk-off pressure beyond crypto. Bitcoin has increasingly traded like a high-volatility “risk” asset during stress periods. When technology shares and other speculative pockets sell off, crypto often follows as investors reduce exposure across the same risk bucket.

ETF flow dynamics and positioning resets. A major narrative shift has been the market’s sensitivity to fund flows and positioning rather than purely crypto-native catalysts. When sentiment turns and investors pull capital from popular vehicles, that can reinforce downside and dampen dip-buying.

Post-rally hangover. Bitcoin’s late-2024 and 2025 surge—helped by expectations of a friendlier U.S. policy stance—left markets crowded on the long side. When momentum breaks, crowded trades can unwind quickly, making “bitcoin dropping” feel sudden even when the downtrend has been building for months.

Bitcoin news drivers: the levels traders are watching

In fast-moving selloffs, attention naturally shifts to round-number price zones and prior consolidation areas. The recent dive toward the low-$60,000 range has been treated as an important stress test: it’s close enough to recent troughs that a clean break could force more risk reduction, while a firm hold could encourage short covering and tactical buying.

What’s different this time is how quickly price can move through levels intraday. The session range Friday—roughly $60,000 to $70,000—shows how rapidly liquidity can thin out during fear-driven periods, then snap back when sellers exhaust or shorts take profit.

What is bitcoin, and why it moves this way in selloffs

Bitcoin is a decentralized digital asset designed to be transferred and held without relying on a central bank or single administrator. In practice, its day-to-day price is set by global supply and demand across exchanges and investment products, with derivatives markets playing an outsized role in short-term swings.

During sharp downturns, bitcoin can behave less like a stable store of value and more like a leveraged sentiment gauge: when liquidity tightens and investors de-risk, bitcoin often sells off alongside other volatile assets. The presence of 24/7 trading also means stress can build overnight and surface abruptly at set times when traditional markets open.

What to watch next for BTC price USD

The next catalysts are less about mystery announcements and more about observable market signals:

-

Stability after liquidation waves. If large forced-selling bursts fade and intraday ranges narrow, it can be an early sign that sellers are losing control.

-

Flow trends. Continued withdrawals from major investment vehicles can keep pressure on spot demand; steadier flows can help volatility cool.

-

Macro tone. If equities remain under stress, crypto may struggle to sustain rebounds. If risk appetite returns, bitcoin can snap back quickly—but sustained recoveries usually require more than a one-day bounce.

For now, the dominant theme is recalibration: a market that rallied hard is repricing what risk is worth when leverage, liquidity, and sentiment all turn at once.

Sources consulted: Reuters; Bloomberg News; Yahoo Finance; Al Jazeera