Jobs report preview: what to watch in the next BLS Employment Situation

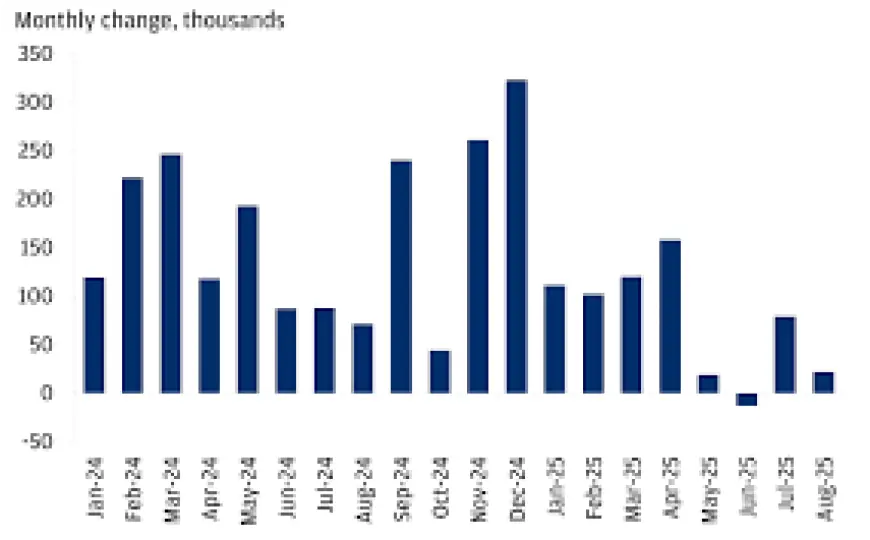

The next U.S. jobs report is set to land Wednesday, Feb. 11 at 8:30 a.m. ET, keeping markets and policymakers in a brief holding pattern after a run of mixed labor market data. With growth slowing from last year’s pace, the coming release will be watched for whether hiring is merely cooling—or slipping toward something weaker—while wage growth remains firm enough to complicate the inflation outlook.

The report in focus is the BLS Employment Situation for January 2026, covering nonfarm payrolls, the unemployment rate, and key wage measures that often shape expectations for interest rates and the broader economy.

What the BLS Employment Situation includes

The BLS Employment Situation blends two surveys that can sometimes tell slightly different stories:

-

The establishment survey drives the headline nonfarm payrolls number and industry hiring.

-

The household survey drives the unemployment rate, participation, and measures of labor market slack.

Because January data often comes with larger seasonal adjustments, investors tend to look beyond the top-line headline and into wages, hours, and revisions for confirmation.

The baseline: where the labor market stood in December

The most recent official benchmark is December’s report, which showed a clear cooling in job creation without an abrupt break in the broader labor market backdrop. Nonfarm payrolls increased 50,000 in December, while the unemployment rate held at 4.4%. Average hourly earnings rose 0.3% to $37.02, leaving wages up 3.8% over the past year.

Key indicators to track

| Measure | Latest reading (December) | Why it matters for January |

|---|---|---|

| Nonfarm payrolls | +50,000 | Signals hiring momentum and breadth |

| Unemployment rate | 4.4% | Gauges slack and household-side conditions |

| Wage growth (avg. hourly earnings) | +0.3% m/m; +3.8% y/y | Helps frame inflation pressure risk |

| Labor force participation | 62.4% | Shapes how job gains translate into unemployment |

| Average workweek (private) | 34.2 hours | A canary for demand and staffing needs |

A key context note for interpreting the trend: payroll growth for 2025 totaled 584,000 (about 49,000 per month on average), far below the prior year’s pace.

What markets want from January: three big questions

1) Is hiring slowing, or stalling?

Recent private indicators have pointed to softer job creation and a more cautious hiring mood. If the January nonfarm payrolls print is modest but steady, it supports the “cooling, not collapsing” narrative. A very small gain—or a surprise decline—would likely shift attention to recession-risk chatter and heighten sensitivity to every subsequent data point.

2) Does the unemployment rate hold near 4.4%, or drift higher?

Even small changes in the unemployment rate can affect the policy discussion when inflation progress is uneven. A stable reading would reinforce the idea of a labor market easing gradually. A step up would amplify debate about whether restrictive policy is biting more than intended—especially if participation does not rise alongside it.

3) Is wage growth re-accelerating or cooling?

Wage growth is one of the stickiest parts of the inflation puzzle. If average hourly earnings stay around a 0.3% monthly pace and the year-over-year rate remains elevated, it becomes harder to argue that inflation pressures will fade quickly. A cooler wage print would be the clearest “relief valve” in this report for those looking for inflation to trend down more smoothly.

Revisions, seasonal factors, and why January can surprise

January is notorious for larger seasonal adjustment effects, which can produce headline surprises even when the underlying trend is steady. That makes revisions and complementary indicators unusually important:

-

Revisions to recent months can reshape the narrative more than the January headline itself.

-

Hours worked (the workweek) can signal whether firms are trimming labor demand quietly before cutting headcount.

-

Industry details can show whether strength is concentrated in a few categories or broad-based.

Investors will also watch whether the report’s internal measures of slack—like part-time work for economic reasons—show meaningful movement.

How to follow the release and react responsibly

The cleanest way to track the numbers is to focus on three lines first—nonfarm payrolls, unemployment rate, wage growth—then confirm the story with revisions and hours.

A practical approach for readers and traders:

-

Treat a single headline surprise cautiously until revisions and hours confirm it.

-

Pay attention to whether wage growth cools even when payrolls are softer (that combination matters most for inflation).

-

Watch participation: it can change the unemployment story without reflecting a true shift in labor demand.

The Feb. 11 report won’t settle every debate, but it will be the most important fresh labor market datapoint for shaping near-term expectations—especially with inflation still not fully back to target.

Sources consulted: U.S. Bureau of Labor Statistics; The Wall Street Journal; Barron’s; S&P Global Market Intelligence