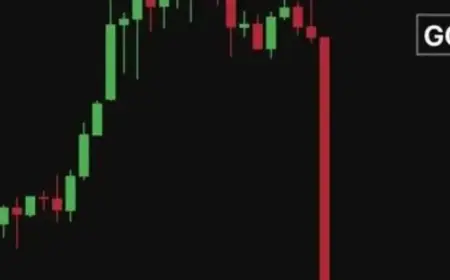

Sandisk Stock Soars After Long-Awaited Upgrade and Blowout Earnings

The latest developments at Sandisk have captured the attention of investors and analysts alike. Recent earnings reports indicate a significant increase in the company’s stock value, with shares rising by a remarkable 1,400%. This surge is largely attributed to the growing demand for storage solutions, which has exceeded market expectations.

Sandisk’s Impressive Earnings Report

On January 30, 2026, Sandisk (SNDK) announced its quarterly earnings, showcasing exceptional performance metrics. The company’s revenue guidance for the next quarter not only beat market projections but exceeded them by nearly 60% at its midpoint. Furthermore, their profit outlook astonished analysts by surpassing estimates by an impressive 150%.

Key Financial Highlights

- Stock Increase: 1,400% rise in stock value.

- Revenue Guidance: Surpassed expectations by 60%.

- Profit Outlook: Exceeded estimates by 150%.

These statistics underscore Sandisk’s robust financial standing and its ability to capitalize on the increasing demand for data storage. The company’s performance illustrates a promising trajectory, which analysts believe signals further growth potential for its stock. Given the ongoing expansion in the technology sector, Sandisk appears well-positioned to continue its upward momentum.

Future Outlook for Sandisk

Analysts are optimistic about Sandisk’s future, anticipating that the company’s stock may have even more room for appreciation. With storage demands on the rise, Sandisk’s innovative solutions and strong earnings present a compelling case for continued investment. The company is not only meeting current market needs but is also prepared to adapt to future technological advancements.

In summary, Sandisk’s stock rally and exceptional earnings reflect its strategic positioning within the tech industry. As the demand for storage solutions continues to expand, investors are encouraged to keep an eye on Sandisk as a significant player in this evolving market.