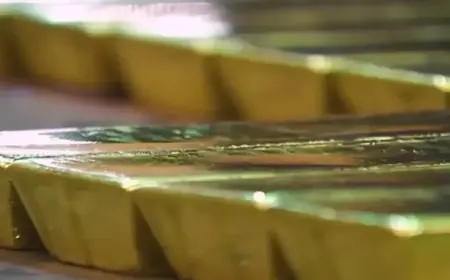

Price of gold today drops sharply after Warsh Fed chair nomination

The price of gold today is sharply lower on Friday, Jan. 30, 2026, as traders unwind an extraordinary January rally and recalibrate for a potentially different U.S. rate path after President Donald Trump moved to nominate Kevin Warsh as the next Federal Reserve chair. Gold briefly slipped under the psychologically important $5,000 level overnight before stabilizing, but it remains far below Thursday’s record area.

The swing is being amplified by positioning: a crowded, fast-moving trade can reverse hard when a single headline shifts expectations for the dollar, real yields, and financial conditions.

Price of gold today: the live levels snapshot

Below is a late-morning look at key gold references in ET (spot can vary by feed and moment):

| Measure | Level (ET) |

|---|---|

| Spot gold (bid/ask, ~12:00 p.m.) | $5,004.10 / $5,006.10 per oz |

| Spot gold day’s range (so far) | $4,943.90 – $5,452.00 per oz |

| CME gold futures (GC, Feb, ~12:07 p.m.) | $5,006.2 per oz |

| SPDR Gold Shares (GLD, latest) | $456.87 |

| Thursday’s record high (spot) | $5,594.82 per oz |

What flipped the market so fast

Gold’s tumble is tied to a rapid shift in the “rates narrative.” Warsh is a former Fed governor with a reputation for emphasizing credibility and the costs of letting inflation expectations drift. Even without any immediate policy change, a new chair prospect can move markets because it influences what traders think the Fed might do later in 2026 and beyond—especially around how quickly rates could fall and how the Fed might manage its balance sheet.

That shift helped lift the U.S. dollar off recent lows. A stronger dollar can pressure gold because bullion is dollar-priced, raising the effective cost for many buyers outside the U.S. When the market is already overextended, the dollar’s move can be the spark for a broader liquidation.

Profit-taking after a historic January surge

Even after Friday’s drop, gold is still on track for one of its strongest months in decades. The rally earlier this month pushed prices through $5,000 for the first time and then kept accelerating, leaving technical indicators stretched and traders sitting on large open profits.

That matters because reversals after parabolic rises often become self-reinforcing:

-

early sellers lock in gains,

-

key round-number levels break (like $5,000),

-

stop-loss orders trigger,

-

leverage is reduced across futures and options.

Once that wave passes, the market usually needs time to rebuild two-way liquidity—buyers want stability, and sellers want proof the top is in.

Silver and the rest of the metals complex also slid

Friday’s selloff is not isolated to gold. Silver, platinum, and palladium all fell sharply as well, a pattern that typically points to broad “metals complex” deleveraging rather than a single-asset story.

When multiple related contracts move together, it often reflects mechanical forces—margin calls, risk limits, and systematic strategies cutting exposure—on top of the fundamental story. That’s one reason intraday ranges have widened dramatically: liquidity can thin out right when volatility spikes.

Physical demand supports the floor, but volatility can freeze buying

Physical buying has been an important pillar under the rally, with strong interest from both investors and jewelry markets in Asia. At the same time, extreme volatility can temporarily slow real-world demand. Buyers hesitate to commit when prices are swinging by hundreds of dollars in a session, and dealers may widen spreads while they manage inventory risk.

That creates a push-pull dynamic into the weekend: physical demand can help stabilize dips, but it rarely stops a fast futures-led unwind in real time. The more useful signal will be whether spot gold can hold above major psychological levels into the close and through early next week.

What traders are watching next

The market’s immediate focal points are: (1) how the Warsh nomination progresses through Senate confirmation, (2) whether the dollar continues to strengthen, and (3) whether gold can defend the $5,000 neighborhood after testing below it. If the dollar keeps firming and real yields drift higher, gold could stay under pressure. If volatility cools and the market regains two-way flow, a base-building phase near current levels becomes more likely than an immediate sprint back to record highs.

Sources consulted: CME Group; Kitco; Reuters; Financial Times; Barron’s.