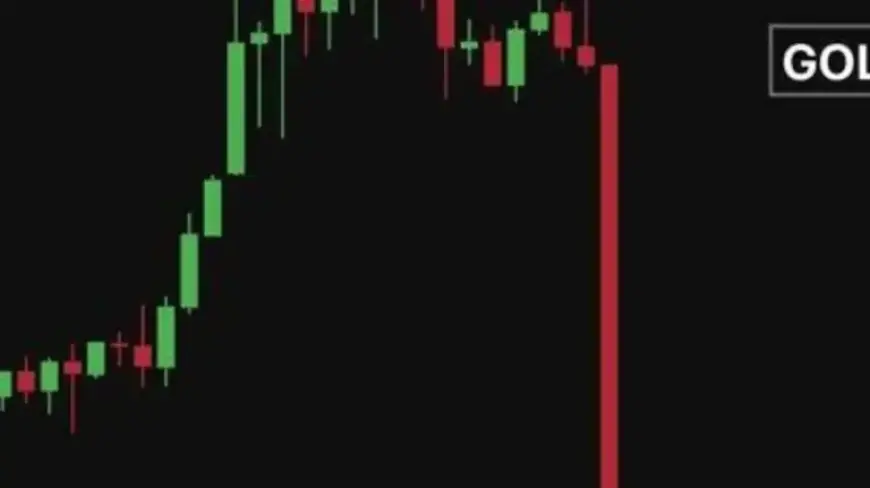

Global Shock as $6 Trillion Vanishes in 30 Minutes

The financial markets experienced a dramatic downturn as roughly $6 trillion vanished from the value of gold and silver within just 30 minutes. This sudden loss occurred amid a surge in oil prices, fueled by escalating geopolitical tensions over Iran.

Precious Metals’ Value Plummets

Gold saw a substantial decrease after reaching a record high of $5,595.47 per ounce. In the same vein, silver peaked at $120.44 per ounce before experiencing a steep decline. Gold fell by over five percent, while silver dropped more than eight percent. Other metals, including copper and nickel, also faced declines as traders reevaluated market conditions.

Market Insights

- Kathleen Brooks, research director at XTB, noted that the rapid increase in commodity prices had to come to an end.

- Investor sentiment shifted towards safer assets due to uncertainty surrounding the U.S. dollar.

- Speculation regarding President Trump’s views on the dollar’s weakness added to market instability.

Federal Reserve and Interest Rates

The Federal Reserve’s policy announcement failed to inspire buying interest among traders. Many are optimistic about potential U.S. interest rate cuts as President Trump is expected to appoint a new central bank governor soon.

Cryptocurrency Decline

Bitcoin also faced a significant drop, decreasing by 5.42%. Over the past year, it has fallen close to 27%, despite being promoted as a hedge against declining fiat currencies.

Rising Oil Prices Amid Geopolitical Tensions

Oil prices surged significantly after President Trump threatened military action against Iran. International benchmark Brent crude briefly exceeded $70 per barrel, marking a five percent increase.

Impacts on Global Markets

This spike in oil prices raises concerns about inflation and its effects on interest rate policies globally. Jason Tuvey, an economist, warned that potential military strikes could exacerbate oil price instability.

- Higher oil costs could prompt central banks to reconsider the pace of interest rate cuts.

- Energy sector stocks benefited from the rise in oil prices.

Mixed Results in Tech Earnings

Global stock markets displayed mixed performance. For instance, Meta Technologies saw a remarkable increase exceeding 10% after reporting strong quarterly earnings. Conversely, Microsoft’s disappointing earnings led to a nearly 10% downturn in its stock value.

This divergence highlights the market’s critical approach to technology investments, particularly regarding artificial intelligence spending.

As markets adjust to these financial upheavals, investor sentiment continues to shift, reflecting the uncertainties present in the global economy.