Can Investing in Micron Technology Stock Make You a Millionaire by 2026?

Micron Technology is emerging as a significant player in the tech industry, particularly amid the surge of interest in artificial intelligence. Despite being less recognized than giants like Nvidia and Apple, Micron’s stock has appreciated dramatically—up 254% over the past year. This trend raises the question: Can investing in Micron Technology stock make you a millionaire by 2026?

Micron’s Market Position and Performance

Micron specializes in memory chips essential for storing data and supporting AI calculations. The recent rise of generative AI has created a strong demand for these memory solutions. Analysts predict cloud service companies will spend around $527 billion on capital expenditures, a portion of which is expected to flow into memory chip purchases.

Key Financial Metrics

- Current Stock Price: $389.09

- Market Capitalization: $450 billion

- Day’s Price Range: $384.30 – $398.00

- 52-Week Price Range: $61.54 – $412.43

- Volume: 29 million shares

- Gross Margin: 45.53%

- Dividend Yield: 0.12%

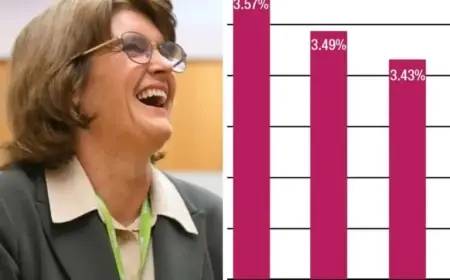

Growth Projections

Micron’s revenue rose significantly, with a 57% year-over-year increase in its latest fiscal quarter, reaching $13.6 billion. This growth is largely driven by the demand from AI data centers. Management anticipates a bright future, projecting a total addressable market for its high-bandwidth memory devices to reach $100 billion by 2028, with a 40% compound annual growth rate.

Challenges Ahead

While Micron is currently flourishing, the memory sector is known for its cyclical nature. Prices can fluctuate as demand changes, potentially leading to reduced profit margins. However, Micron’s robust cash flow positions it well for managing these challenges.

Investing and Future Potential

Despite impressive growth metrics and a strong cash position—reportedly $3.9 billion in adjusted free cash flow—Micron’s shares are trading at a relatively low forward price-to-earnings (P/E) ratio of 11.5. This is significantly lower than the S&P 500 average of 22 and Nvidia’s ratio of 24.

Opportunities for Investors

Historically, investors have already seen substantial returns; an initial investment of $50,000 five years ago would be valued at approximately $228,000 today. Given Micron’s current valuation and growth prospects, there remains a considerable opportunity for investors looking to achieve millionaire status by 2026.

For those willing to maintain a long-term investment strategy, Micron’s stock could offer significant rewards. The company’s share buybacks may enhance value over time, reinforcing its potential for steady growth, even amidst industry fluctuations.