Asian Stocks Surge to Record High on Strong Earnings Amid Korea Tariff Concerns

Asian stocks have surged to record highs, driven by strong earnings expectations, despite recent tariff concerns from the U.S. regarding South Korea. This positive outlook has overshadowed uncertainties stemming from President Donald Trump’s tariff announcements.

Strong Earnings Drive Asian Markets

On Tuesday, the MSCI index tracking Asia-Pacific shares outside Japan reached a new high, rising by 0.9%. In South Korea, the KOSPI index rebounded from earlier losses to gain over 2%, achieving a record peak. Analysts attribute this surge to investor optimism ahead of significant earnings reports from major tech companies.

Key Earnings Reports Ahead

- Microsoft (MSFT)

- Apple (AAPL)

- Tesla (TSLA)

These companies are set to announce their performance starting Wednesday, further boosting investor confidence in tech sectors.

Impact of Tariff Concerns

President Trump recently announced plans to increase tariffs on imports from South Korea to 25%. His comments criticized South Korea’s adherence to trade agreements, adding tension to U.S.-Korea relations. Despite this, Jose Torres, a senior economist at Interactive Brokers, believes a potential diplomatic visit by South Korean officials could alleviate some concerns.

Reaction in Commodity Markets

The uncertainty surrounding tariffs has led to a rise in safe-haven commodities. Gold prices have increased by 1%, nearing historical highs, while silver climbed by 4%. As of now, gold is priced at approximately $5,065 per ounce, while silver holds at about $108 per ounce.

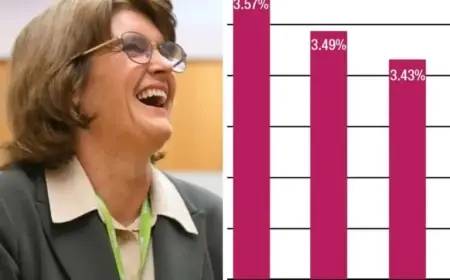

Gold and Silver Statistics

| Commodity | Current Price | Previous Record High |

|---|---|---|

| Gold | $5,065 | $5,110 |

| Silver | $108 | $117.70 |

Commodity strategist Christopher Louney has indicated that this upward trend may continue into late 2026, with potential gold prices reaching up to $7,100 per ounce.

Currency and Market Reactions

The U.S. dollar faced renewed pressure as it fell to lows not seen in over four months. Factors influencing this decline include anticipated U.S. government policy changes and the fluctuating Japanese yen. The dollar was reported at 154.55 yen, reflecting a significant loss in recent sessions.

In the oil market, Brent crude futures declined by 0.7%, settling at $65.13 per barrel while U.S. West Texas Intermediate crude fell 0.6% to $60.25.

The combined influence of earnings optimism and geopolitical tensions has created a volatile environment for Asian stocks and commodities alike. Investors continue to monitor the situation closely as developments unfold.