Bank’s Bold Inflation Forecast Puts Interest Rates in Focus

Interest rates are a primary concern as inflation predictions loom larger. The Commonwealth Bank of Australia (CBA) has issued a bold inflation forecast, suggesting a potential interest rate hike. This news could significantly impact millions of mortgage holders who primarily rely on variable rate loans.

Key Inflation Predictions by CBA

CBA has predicted that the quarterly trimmed mean inflation figure will hit 0.9% for Q4 2025. This forecast deviates from the previous quarter’s 1.0% increase. Despite being lower, it exceeds the inflation pace necessary for the Reserve Bank of Australia (RBA) to meet its target.

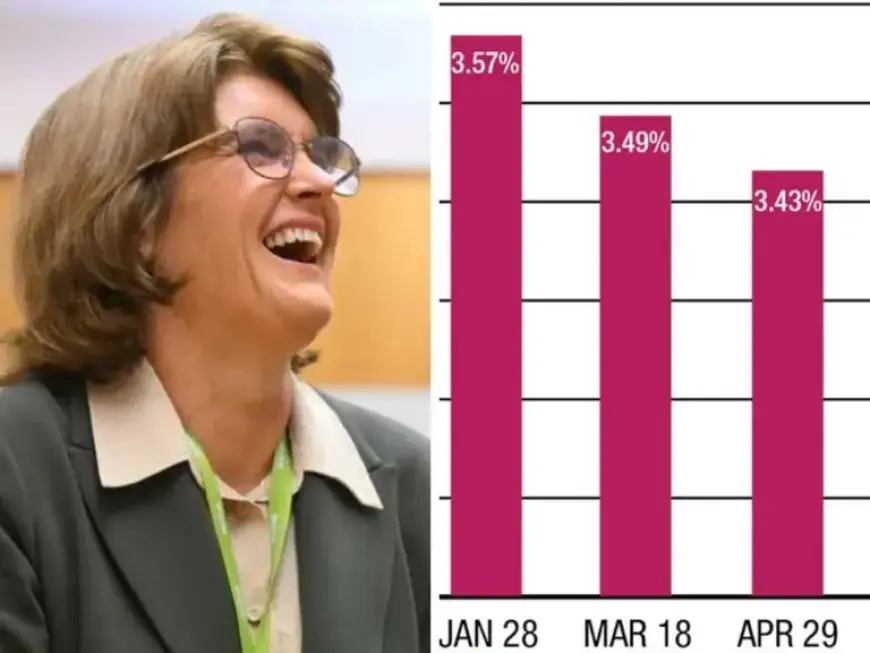

Annual Inflation Rates

According to CBA, annual trimmed mean inflation is expected to rise to 3.3%, up from 3.0% in Q3 2025. Additionally, the overall headline inflation rate is anticipated to reach 3.8% in December. This figure surpasses the consensus of 3.6% among economists and remains above the RBA’s goal of 2-3%.

RBA Rate Decision Pressures

- The CBA’s forecast emphasizes strong underlying inflation pressures.

- Michele Bullock, RBA Governor, may face immense pressure to raise the cash rate.

- The inflation data will be reviewed closely at the upcoming RBA meeting.

Impact on Mortgage Holders

Most mortgage repayments hinge on variable rates, making borrowers vulnerable to changes in the cash rate. A projection of a 0.25% increase could raise monthly payments significantly:

| Loan Amount | Monthly Increase |

|---|---|

| $600,000 | $90 |

| $750,000 | $112 |

| $1,000,000 | $150 |

Market Reactions and Future Expectations

The major banks appear divided on the interest rate outlook. Commonwealth Bank and NAB are anticipating a rate hike, while Westpac expects rates to remain unchanged. ANZ acknowledges the potential for a hike, contingent upon the 0.9% inflation figure.

All eyes are now on January 29, when the Australian Bureau of Statistics will release the official CPI data. This announcement will clarify whether the CBA’s predictions hold true and determine the financial futures of mortgage holders across Australia.