US Plans 2027 Medicare Insurer Payment Hike; Stock Prices Drop

The U.S. government has proposed a modest average payment increase for Medicare Advantage plans, which has prompted a significant drop in health insurer stock prices. This announcement, made on January 26, 2023, may have far-reaching implications for insurers and their customers.

Details of the Proposed Increase

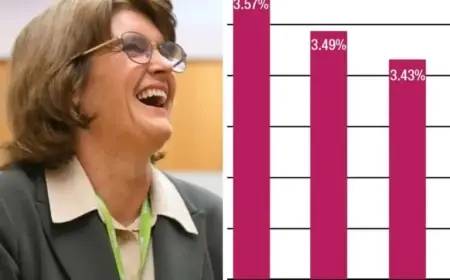

The Centers for Medicare & Medicaid Services (CMS) announced a 0.09% average rate increase for Medicare Advantage insurers in 2027. This change is expected to generate over $700 million in additional payments for the insurance plans managed by private companies. The adjustment is based on various factors, including underlying cost trends and 2026 quality ratings.

Industry Reactions

The proposed rate hike has caused substantial stock drops for major health insurance providers. Notably, the following companies experienced declines ranging from 8% to 13%:

- UnitedHealth (UNH.N)

- CVS Health (CVS.N)

- Humana (HUM.N)

Other insurers, such as Elevance Health (ELV.N), Centene (CNC.N), and Molina Healthcare (MOH.N), saw their stock prices drop nearly 5% in after-hours trading.

Concerns from Industry Experts

Industry experts have expressed concerns about the impact of flat funding amidst rising medical costs. Kevin Gade, COO at Bahl and Gaynor, emphasized expectations for a rate closer to 4-5%, considering the demand for senior care insurance. He noted that insurers’ margins and earnings per share estimates would be directly affected by the proposed rates.

Future Developments

Insurers await further insights during UnitedHealth’s upcoming conference call, where CEO Stephen Hemsley will discuss the implications of the new payment structure. Analysts, including Julie Utterback from Morningstar, are closely monitoring whether CMS might revise its projections before the final rule is announced.

Potential Impacts of the Proposal

The release of the final rate announcement is scheduled for April 6, 2023. Should the proposed rates be finalized, health plans could face significant challenges. Chris Bond, spokesperson for America’s Health Insurance Plans, stated that this strategy could lead to benefit cuts and increased costs for seniors and people with disabilities.

Currently, more than 35 million individuals enrolled in the Medicare program for seniors and disabled persons receive their coverage through Medicare Advantage plans. This demographic could be significantly affected by the proposed changes. The evolution of these policies will ultimately shape the future landscape of Medicare Advantage and its benefits.