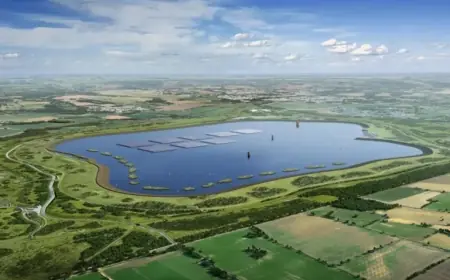

Toronto Real Estate Faces 45-Year Low in New Home Sales, Threatening 100,000 Jobs

The Toronto real estate market is experiencing an unprecedented downturn, with new home sales plummeting to a 45-year low. According to the Building Industry and Land Development Association (BILD), the impact of this decline has serious implications for both employment and the economy in Ontario. The situation is dire and demands urgent attention.

Record Low New Home Sales

In 2025, the Greater Toronto Area (GTA) recorded only 5,300 new home sales, the lowest since sales data became available 45 years ago. Edward Jegg, research manager at Altus Group, emphasized the dire nature of the market, noting that sales in December 2025 were drastically down by 82% compared to the 10-year average of 1,327 units.

Factors Contributing to Decline

Ongoing geopolitical concerns and high prices are key factors affecting buyer behavior. The Bank of Canada has indicated that interest rate cuts are no longer expected, further complicating the recovery of the housing market.

- New condo average price: $1.02 million

- New single-family home average price: $1.4 million

- Record cancellation of condo projects: 28 projects, 7,243 units in 2025

Job Losses and Economic Impact

Experts warn that the prolonged slump in new home sales could jeopardize up to 100,000 jobs in Ontario’s construction sector. According to Altus Group, new home building typically supports over 220,000 jobs in the province.

Uncertain Future for New Constructions

The inventory of unsold new homes in the GTA remains high, with 20,849 homes available but a selling period stretching to 26 months. Comparatively, a healthy market should ideally have an inventory period of 9 to 12 months.

Market Correction Needed

While industry leaders advocate for actions to reduce construction costs and boost new home sales, some economists argue that the current downturn is a necessary correction following skyrocketing prices post-pandemic. Douglas Porter from BMO suggests that returning to a more sustainable level of affordability is essential for long-term growth.

Call for Government Intervention

To stimulate the market, experts call for policy changes including:

- Elimination of HST on new homes

- Reduction in development charges, which could lower costs significantly

The construction sector is vital for Ontario’s economy, contributing nearly 10% at its peak. However, this percentage has now plummeted to below 7% as the market continues to stagnate.

Conclusion

As the Toronto real estate market grapples with historic lows in new home sales, the stakes are high. Without timely and effective intervention, hundreds of thousands of jobs and the broader economy could face serious repercussions.