Iranian Canadians Sue B.C. Currency Exchange for Alleged Thousands in Debt

Customers of a foreign currency exchange in British Columbia, known as VanEx Currency Exchange, have initiated lawsuits claiming they are owed substantial amounts of money. The business primarily manages money transfers between Canada and Iran. Recently, Coquitlam RCMP have launched an investigation into the allegations made by these clients.

Overview of Allegations Against VanEx Currency Exchange

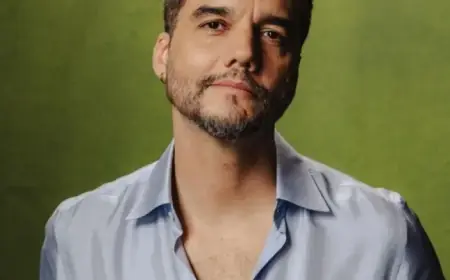

Several customers, including eight individuals who have approached small claims court, allege that VanEx has failed to return significant sums of money. In a meeting with the company president, Pouria Emadi, clients expressed their dissatisfaction and concerns regarding their funds. Emadi has stated that the company is cooperating with authorities and intends to settle all debts by July. He attributed the financial issues to internal disputes among the founders and the ongoing unrest in Iran.

Customer Experiences and Lawsuits

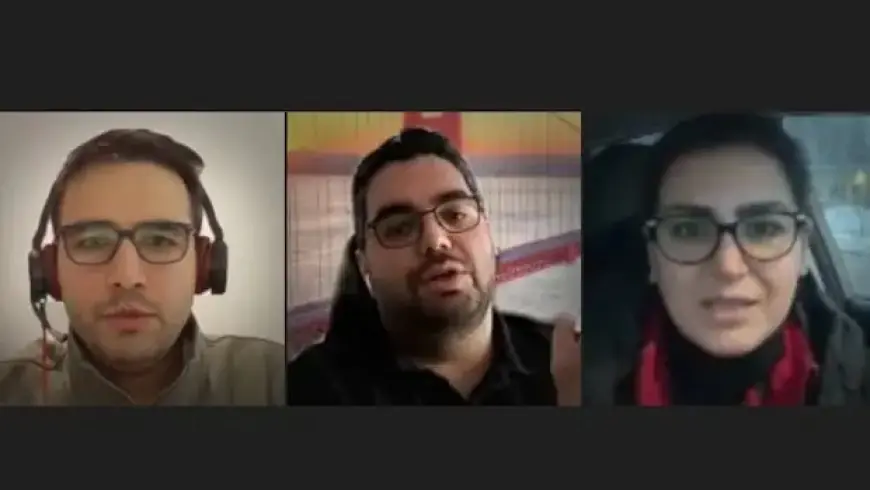

Many affected individuals, like Sharereh Momeni, are distressed about potential losses. Momeni claims to have lost $7,600, which she earned over three months working at a campground. She borrowed money in Tehran to facilitate her relocation to Canada and feels betrayed by an officially registered company. Momeni filed her small claims lawsuit in December.

- Storage and Debt: VanEx reportedly owes Momeni and others substantial amounts.

- Complicated Operations: Emadi cited operational challenges caused by unrest in Iran.

Legal Background and Company Structure

VanEx was founded in 2019 to streamline money transfers between Canada and Iran. However, U.S. sanctions complicate these transactions, affecting the company’s operations. Initially employing one person, the firm has grown to 14 staff members and reported revenues exceeding $1.7 million in 2023.

In 2024, Emadi noted significant operational difficulties due to disputes with his co-founder. This issue culminated in a B.C. Supreme Court order for a “shotgun” sale, compelling one partner to sell their shares to the other.

Unsettled Debts and Customer Complaints

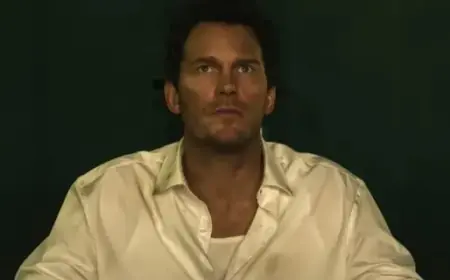

Customer Masoud Ghorbani detailed his experience, stating he transferred CAD 21,009 from Iran, yet only received CAD 6,009. He visited the Coquitlam branch several times, finding that many others faced similar problems. VanEx has admitted to incurring losses around CAD 700,000 but continues to operate and accept new deposits.

- Ongoing Operations: Despite debts, VanEx continues to conduct business as usual.

- Court Orders: Emadi managed to rescind his co-founder’s share, further complicating business operations.

Regulatory Oversight and Customer Rights

Many customers have expressed frustration with the local financial services authority, which has yet to fully enact regulations introduced in 2023. This legislation aimed to regulate B.C.’s money services industry but remains a work in progress.

Though individuals can file lawsuits or contact law enforcement, many feel abandoned by the regulatory process. Ghorbani criticized the slow government response, highlighting the struggles faced by customers seeking restitution.

Steps Forward for Affected Customers

VanEx has begun discussions about repayment, with plans for future payouts. However, many clients remain skeptical about the company’s ability to resolve the ongoing financial issues. Emadi has assured customers that promises of repayment will be kept, with a second round of payments expected in February 2026.

The situation at VanEx Currency Exchange raises pressing questions about consumer protection within financial services in British Columbia. As more customers seek justice, the continuing investigations by the Coquitlam RCMP and the financial watchdog underscored the urgent need for effective regulatory oversight.