JPMorgan, Jamie Dimon, and “Debanking”: Trump’s $5 Billion Lawsuit Reignites a Global Fight Over Who Banks Serve

A fresh legal clash is pushing “debanking” back to the center of U.S. politics and financial regulation, with JPMorgan Chase and CEO Jamie Dimon now facing a $5 billion lawsuit tied to claims that accounts were closed for political reasons. Filed on Thursday, January 22, 2026, in Florida state court, the case is already shaping up as a high-stakes test of how banks explain account exits, how regulators frame risk, and how far politics can reach into compliance decisions.

At the heart of the dispute is a question that has become increasingly combustible on both sides of the Atlantic: when a bank ends a customer relationship, is it enforcing risk rules—or policing viewpoints?

What the lawsuit says about JPMorgan, Jamie Dimon, and debanking

The complaint centers on the allegation that JPMorgan closed personal and business accounts connected to President Donald Trump, with the plaintiff arguing the move was politically motivated and carried out without fair warning. The filing seeks at least $5 billion in damages and names Jamie Dimon alongside the bank, elevating the matter beyond a routine commercial dispute and into reputational territory for the largest U.S. lender.

JPMorgan’s position is blunt: it says it does not close accounts for political or religious reasons and that decisions to exit customers are driven by legal, regulatory, and risk considerations. The bank’s stance reflects a consistent theme in the debanking debate—institutions argue they are navigating obligations tied to sanctions screening, anti-money-laundering controls, fraud prevention, and broader regulatory expectations.

That tension—customers demanding “why,” banks citing “risk”—is exactly what has made debanking a durable political issue.

Debanking, defined: why accounts get closed even without wrongdoing

“Debanking” is commonly used to describe sudden or unexplained account closures or denial of services. In practice, banks often describe the same action as “offboarding” or “exiting” a customer relationship. The triggers can be mundane, serious, or simply opaque:

-

Documentation gaps or inability to complete due diligence checks

-

Transaction patterns that raise compliance alerts

-

Elevated fraud exposure or identity concerns

-

Sanctions, politically exposed person screening, or cross-border risk flags

-

“Reputational risk” judgments that some regulators and lawmakers now want limited or defined more tightly

The controversy grows when a customer is not told the specific reason. Banks frequently avoid detail because disclosures can reveal monitoring methods or tip off bad actors—yet that silence fuels claims of discrimination or politically motivated targeting.

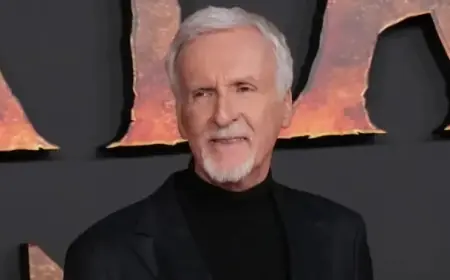

Why Jamie Dimon is central to the debanking story

Jamie Dimon has become a focal point because JPMorgan sits at the crossroads of politics, regulation, and scale. When the biggest bank changes its approach to account exits, smaller institutions and regulators take notice. The lawsuit also arrives as Dimon remains an unusually visible banking executive in public policy debates—often urging clearer rules so banks are not forced to act as de facto arbiters of controversial speech, industries, or political movements.

In debanking disputes, the public-facing dynamic typically follows a familiar loop:

-

A customer claims viewpoint discrimination.

-

The bank cites compliance and risk frameworks.

-

Lawmakers demand proof and transparency.

-

Regulators warn banks not to enable illicit finance—while also facing pressure to curb overreach.

This case compresses that entire cycle into one headline-making courtroom fight.

Timeline: how the JPMorgan debanking dispute reached court

-

2021: The account closures at issue are tied to that period in the complaint’s narrative.

-

Recent months: Debanking rhetoric intensifies amid political pressure on large banks to justify account exits.

-

January 22, 2026: The Florida lawsuit is filed, seeking at least $5 billion and naming both JPMorgan and Jamie Dimon.

The next procedural steps will likely include motions challenging the legal basis of the claims, potential fights over what internal risk documents can be disclosed, and arguments over whether state consumer-protection standards apply to account relationship decisions.

What this could change for banks and customers

Even before any verdict, high-profile debanking litigation tends to move policy in three ways:

More formalized “exit” playbooks. Banks may tighten documentation around why an account was closed, who approved it, and what notice was given—so decisions can be defended later.

Pressure for transparency rules. Legislators in multiple jurisdictions have explored requiring clearer explanations and longer notice periods for non-crime-related closures, with carve-outs when financial crime risk is present. The lawsuit adds momentum to those conversations in the U.S., especially at the state level.

A sharper debate over “reputational risk.” Critics argue reputational risk is a subjective backdoor for viewpoint-based decisions. Banks counter that reputational damage can become a material risk affecting safety and soundness. How courts and regulators treat that concept will influence debanking policy broadly.

What to watch next in the JPMorgan–Jamie Dimon debanking fight

Three developments will signal where this is headed:

-

Whether the court demands specific evidence of political motive versus accepting compliance/risk rationale as sufficient absent proof.

-

Discovery battles over internal emails, committees, and risk scoring, which can set precedents for what banks must reveal when challenged.

-

Spillover into regulation, including possible rulemaking or state-level legislation aimed at limiting account closures tied to non-financial criteria.

For now, the core facts are straightforward and on the record: a sitting U.S. president has put JPMorgan and Jamie Dimon in the dock over debanking allegations, and the bank is denying any political basis for its actions. The larger impact may be felt well beyond this one dispute—because whichever side gains ground, the industry’s “close-the-account-and-say-little” model is becoming harder to sustain.