US Bill Delay Shakes Crypto Firms Backed by Trump

The recent delay of a crucial digital-asset bill in the Senate has caused concern among cryptocurrency firms, particularly those with ties to Donald Trump. This delay comes amid intense discussions surrounding the treatment of stablecoins.

Delay in Senate Discussion of Digital-Asset Bill

On Wednesday, the Senate Banking Committee postponed its meeting to discuss the anticipated bill. This decision followed Coinbase Global Inc.’s withdrawal of support for the latest bill version. Coinbase and other firms are primarily disputing provisions that would limit their ability to offer yield or rewards on stablecoin holdings.

Impact of Stablecoins on the Crypto Market

Stablecoins serve as a vital component of the cryptocurrency ecosystem, with their usage surging after the U.S. passed legislative measures related to them in July. Executives worry that delays over stablecoin regulations may hinder the U.S. regulatory framework’s progress compared to other markets.

- Stablecoins are pegged to the dollar and have gained traction recently.

- Concern exists that without clear regulations, the U.S. may fall behind by 2026.

Dea Markova, director of policy at Fireblocks, expressed that this uncertainty might lead to the U.S. becoming one of the few major digital asset hubs lacking a comprehensive market rulebook.

Market Reaction to Bill Delays

Investors reacted negatively to Coinbase’s announcement, with its shares dropping by as much as 4%. Other companies, including Circle Internet Group Inc. and Gemini Space Station Inc., experienced declines of approximately 5%.

The latest proposal from lawmakers suggests a ban on paying stablecoin yields, though certain rewards might still be permitted. This ambiguity raises questions regarding the types of rewards that could be offered, as highlighted by Nana Murugesan, a former senior executive at Coinbase.

Rewards and Incentives within the Crypto Space

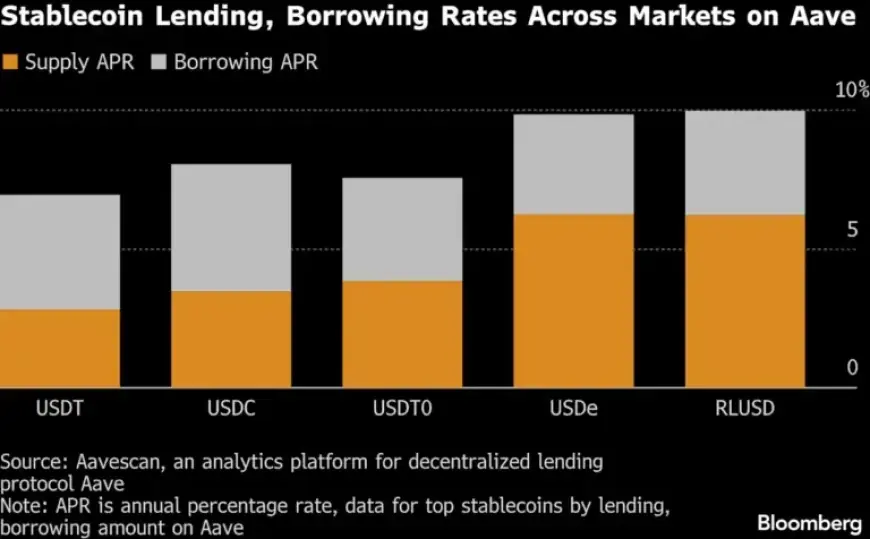

Crypto firms have frequently relied on yield and rewards to encourage users to retain their digital assets instead of converting them to fiat. For example, Ethena’s USDe offers yield structurally, and Coinbase provides rewards to users holding Circle’s USDC, similar to those offered by traditional savings accounts.

- Stablecoin rewards bridge payments and savings-like behaviors.

- Uncertainties surrounding regulations may disadvantage U.S.-regulated firms compared to offshore entities.

The banking sector has raised alarms that yield-bearing stablecoins may draw deposits away from conventional banks. Last year’s legislation, known as the Genius Act, allows banks to create their own stablecoins while preventing issuers from providing interest.

Industry Clout and Political Responses

Coinbase’s swift withdrawal of support signals the industry’s growing influence in Washington. Coinbase CEO Brian Armstrong, a known Trump supporter, criticized the latest bill draft on X, citing “too many issues.” This led to a rebuttal from Senator Cynthia Lummis, indicating that crypto companies may not be adequately prepared for the regulatory landscape.