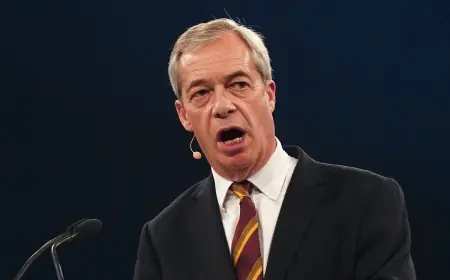

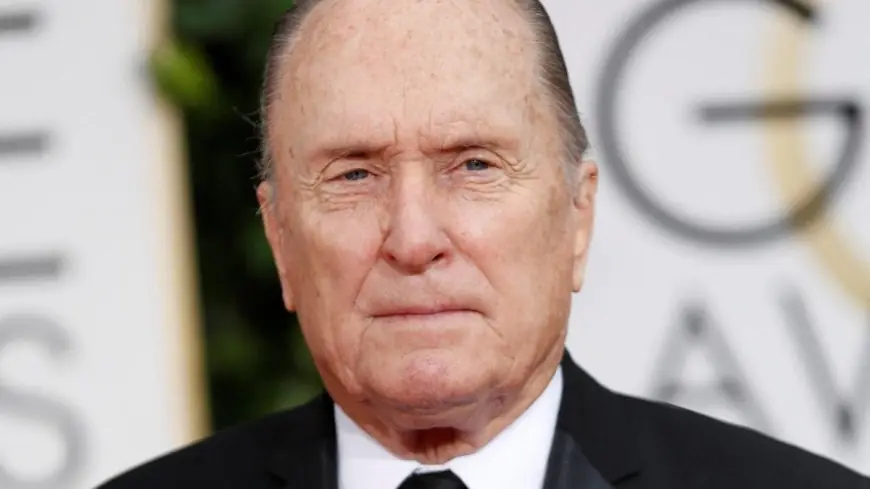

Robert Duvall Net Worth: What We Know About the Actor’s Fortune After His Death at 95

Robert Duvall’s death on February 15, 2026 ET has reignited a familiar question that follows the passing of a long-running Hollywood figure: how much wealth did he actually leave behind. Online estimates cluster in a wide band, most commonly between about 50 million dollars and 70 million dollars, but the true figure is not confirmed publicly and may not be knowable until estate documents, tax filings, or property records become clearer.

That gap between a neat headline number and the messier reality is the story.

Robert Duvall net worth estimates: why the range is so wide

For a star whose career stretched across more than six decades, net worth is less a single number than a moving target shaped by timing, asset mix, and privacy.

A typical public estimate tries to combine four buckets:

First, career earnings. Duvall worked through multiple pay eras, from studio salary structures to modern backend participation. Early roles that became classics do not automatically translate into modern, blockbuster-style payouts, but long careers can quietly generate enormous cumulative income.

Second, residuals and royalties. For film and television, ongoing payments can continue for years, but the amounts vary widely based on contracts, unions, distribution changes, and how rights were negotiated at the time. Streaming-era reshuffles have made those flows harder for outsiders to model.

Third, real estate and land. Duvall was known to keep substantial property, including a large Virginia holding. Real estate often dominates celebrity balance sheets because it is both valuable and illiquid, and because prices can swing sharply depending on local markets and the state of a property.

Fourth, private business interests. Producing, directing, and financing projects can generate profit participation, but they can also tie up cash, create liabilities, or leave behind stakes that are difficult to value from the outside.

Put together, those buckets produce a plausible range, not a precise total.

What’s behind the headline: incentives and stakeholders

There is an incentive mismatch at the heart of celebrity net worth coverage.

Public appetite wants a simple number, ideally a dramatic one. The celebrity’s estate, by contrast, usually prefers privacy and control. Beneficiaries and business partners may be motivated to keep valuations conservative for taxes, or at least not to inflame speculation that invites scrutiny.

Meanwhile, the people with the strongest visibility into the truth are exactly the ones least likely to publish it quickly: executors, attorneys, accountants, and tax authorities. In many estates, the most meaningful financial details surface only after probate filings, creditor notices, and property transfers begin to appear in records.

What we still don’t know: the missing pieces that decide the final total

Even if the broad range is directionally right, several unknowns could swing the number significantly.

How much of the wealth was in property versus liquid investments. A large landholding can add tens of millions on paper while generating limited spendable cash.

Whether there were substantial debts, mortgages, or business liabilities. High-net-worth individuals often carry leverage for tax planning or investment reasons.

How rights and profit participation were structured for major titles. A single contract clause can separate modest residual income from meaningful long-term payouts.

Whether there were philanthropic commitments, trusts, or private transfers made during his lifetime. Those can reduce the estate while still reflecting wealth that existed.

Second-order effects: what happens when a legacy estate meets a modern market

The most immediate ripple effects are practical. If key assets are illiquid, executors sometimes sell property or consolidate holdings to cover taxes and administrative costs. That can move local real estate inventory, shift land conservation outcomes, or trigger renewed interest in nearby communities if a high-profile property changes hands.

There can also be reputational and commercial effects. Renewed attention often boosts demand for a late actor’s catalog, which can raise short-term revenue flows. But that does not automatically mean the estate captures most of it, because distribution and rights splits vary.

What happens next: realistic scenarios to watch in the coming months

One, estate filings become public in stages, narrowing the uncertainty band. Trigger: probate milestones and visible asset transfers.

Two, a notable property sale or restructuring becomes the clearest clue to scale. Trigger: listing activity, deed transfers, or sales records.

Three, catalog revenue rises briefly as audiences revisit major work. Trigger: spikes in rentals, purchases, and broadcast programming shifts.

Four, disputes emerge quietly over valuation, royalties, or beneficiaries. Trigger: legal motions, creditor claims, or delayed settlement timelines.

Five, a long-term legacy plan takes shape through a foundation, archive, or controlled licensing strategy. Trigger: formal announcements from representatives, or structured entity filings tied to rights management.

Why it matters beyond curiosity

Robert Duvall’s net worth question is ultimately a window into how creative labor is monetized over time. The public sees iconic performances; the balance sheet reflects decades of contract terms, ownership structures, land decisions, and the unglamorous mechanics of rights and taxes.

For now, the most responsible answer is a range, not a certainty: widely circulated estimates place his fortune roughly in the 50 million to 70 million dollar neighborhood, while the definitive figure remains unconfirmed pending clearer estate documentation.