Toys “R” Us Bankruptcy Leaves Creditors Scrambling

The recent bankruptcy proceedings of Toys “R” Us Canada have left many creditors scrambling to recover outstanding debts. The retail chain, once an iconic name in the toy industry, has been granted court protection from its creditors amid significant financial challenges.

Toys “R” Us Bankruptcy Overview

This bankruptcy marks a critical moment for the Canadian division of Toys “R” Us, which has been struggling with its finances. The company has closed around 50 stores over the past year, reducing its footprint to 22 locations, primarily in Ontario. If the business cannot attract new investors or sell its operations, it may face liquidation.

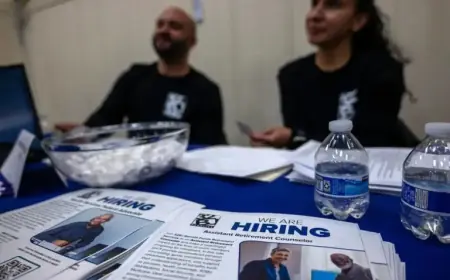

Impact on Creditors

Toys “R” Us owes considerable amounts to various creditors, highlighting the chain’s precarious financial situation. Some of the notable debts include:

- $6.7 million to Lego Canada Inc.

- Over $11 million to associates of Mattel Inc., including companies in Canada and China

- $3.7 million to Spin Master Corp. in Hong Kong

- $2.6 million to Jazwares LLC

- $2.2 million to Hasbro Canada Corp.

Creditors often find themselves at the back of the line during bankruptcy proceedings. They may recover little to none of what they are owed, particularly if they rank behind secured lenders.

Financial History and Challenges

The U.S. parent company, Toys “R” Us Inc., filed for bankruptcy in 2017, leading to the liquidation of its American and British stores. The Canadian subsidiary was sold to Fairfax Financial Holdings Ltd. in 2018 for $300 million, allowing it to temporarily escape the wave of closures. However, after a failed turnaround effort, Fairfax sold the brand to Putman Investments Inc.

Since this acquisition, Toys “R” Us Canada has seen significant layoffs and closures, with 59 stores shut down. The company attempted to innovate by creating indoor play areas in stores to increase foot traffic, but these measures have not sufficiently boosted sales.

Financial Losses

In recent years, the financial situation has deteriorated sharply. In 2024, Toys “R” Us Canada reported a net loss of $54.7 million and, by November 2025, losses had risen to an additional $170.4 million. The company could not sustain operations and halted payments to vendors and landlords, prompting multiple lawsuits for unpaid debts.

Landlord and Supplier Struggles

Many landlords, including notable firms such as Cadillac Fairview, have sought legal remedies over unpaid rent. Among the creditors, Everest Toys, associated with Putman Investments’ leadership, has also faced financial difficulties, contributing to the overall turmoil surrounding Toys “R” Us Canada.

Industry experts note that persistent inflation, rising costs, and post-pandemic shifts toward e-commerce have significantly impacted traditional retailers. Neil Taylor, the recently appointed chief restructuring officer, reflected these challenges in a recent affidavit.

Consequences for Businesses

The repercussions of this bankruptcy extend beyond direct creditors. Marlon McPherson, a liquidator in Toronto, experienced cash flow disruptions after Toys “R” Us defaulted on payments totaling around $200,000 for services rendered. He highlighted that such situations force businesses to reconsider how they engage with clients and tighten their contract stipulations.

As Toys “R” Us Canada navigates through these restructuring efforts, the future remains uncertain. Without decisive action, creditors will continue to face challenges in claiming their owed amounts while the iconic retailer battles to survive against overwhelming odds.