New Shared Home Ownership Scheme Gains Major Popularity

The new Shared Home Ownership Scheme is rapidly gaining traction across Australia. This initiative aims to make homeownership more accessible to a wider range of citizens. With rising property prices, many find it increasingly difficult to purchase a home outright.

What is the Shared Home Ownership Scheme?

The Shared Home Ownership Scheme allows buyers to purchase a share of a property while paying rent on the remaining portion. This arrangement helps to lower the financial burden and makes homeownership feasible for many who may struggle in the current market.

Key Features of the Scheme

- Lower Entry Costs: Participants can buy as little as 25% of a home.

- Rent Payments: Rent is charged on the undivided share owned by the government or housing provider.

- Automatic Growth: As property values increase, so does the value of the equity held by participants.

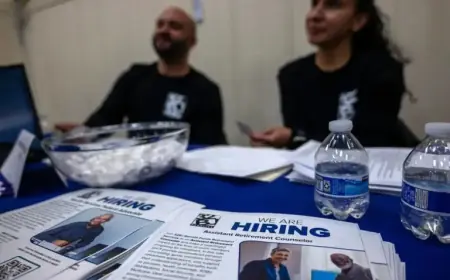

Who Can Participate?

The scheme targets first-home buyers and those struggling to enter the housing market. Eligibility criteria often include income limits and the requirement to live in the home as your primary residence.

Recent Popularity Surge

In recent months, the scheme’s popularity has skyrocketed. Government initiatives and rising awareness are major contributing factors. More first-time buyers are looking for alternative pathways to homeownership.

Conclusion

The Shared Home Ownership Scheme presents a promising opportunity for many Australians. It lowers barriers to entry and addresses the challenges posed by escalating housing prices. As more individuals and families seek stable housing solutions, this scheme could play a crucial role in the changing landscape of homeownership in Australia.