ASX Poised to Rise as Wall Street Rallies and Bitcoin Rebounds

The US stock market experienced a significant recovery on Friday as technology stocks rebounded. The S&P 500 rose by 2%, marking its best performance since May. Meanwhile, the Dow Jones Industrial Average surged 1,206 points, or 2.5%, surpassing the 50,000 milestone for the first time. Additionally, the Nasdaq composite increased by 2.2%, contributing to the optimism on Wall Street.

ASX and Futures Outlook

In Australia, the share market is poised for a strong opening. Futures indicate a rise of 102 points, or 1.2%. This comes on the heels of the ASX’s 2% decline on Friday. The Australian dollar was trading at US70.34¢ early in the morning.

Key Drivers of Market Rally

- Chip companies played a crucial role in boosting Wall Street.

- Nvidia’s stock jumped by 7.8%, while Broadcom gained 7.1%.

- Both companies benefited from expectations of ongoing investments in artificial intelligence technology.

Amazon’s CEO, Andy Jassy, announced planned investments of approximately $200 billion to focus on growth areas such as AI and robotics. However, this raised concerns about whether such expenditures would yield significant profits. Consequently, Amazon’s shares dropped by 5.6%.

Despite the Friday rebound, the S&P 500 recorded its third losing week in four. Concerns linger about Big Tech spending and the impact of AI on software companies.

Bitcoin’s Recovery

Bitcoin stabilized after a prolonged decline, once dropping below its October peak. It regained its footing, trading above $70,000 after briefly dipping to around $60,000. As of early Saturday, Bitcoin was priced at $70,872.

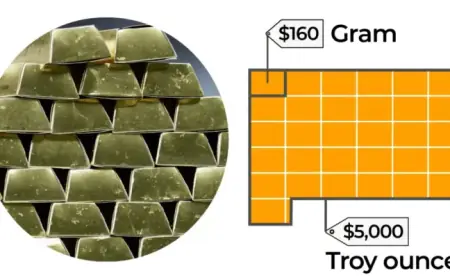

Metals Market Performance

The metals market saw calmer prices following previous volatility. Gold rose by 1.8% to settle at $4,979.80 per ounce, while silver increased by 0.2%. Prior to this, prices had surged due to investor interest in safe-haven assets amidst political uncertainty and global economic challenges.

Impact on Related Stocks

- Robinhood Markets: +14%

- Coinbase Global: +13%

- Strategy: +26.1%

The recovery in Bitcoin also positively affected stocks tied to the cryptocurrency sector. Smaller US companies, particularly those reliant on consumer spending, saw notable gains. A preliminary consumer sentiment report indicated slightly improved feelings among US households, boosting market confidence.

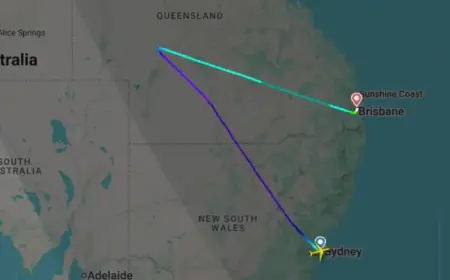

Airline Stocks Surge

Airlines benefitted from the positive consumer sentiment, with significant gains reported: United Airlines +9.3%, Delta Air Lines +8%, and American Airlines +7.6%.

Market Index Performance

The S&P 500 increased by 133.90 points, closing at 6,932.30. The Dow Jones finished at 50,115.67 after a gain of 1,206.95 points. The Nasdaq composite rose by 490.63 points, ending at 23,031.21.

International Markets Reaction

Markets abroad showed a mixed reaction. European indexes generally rose, although the Italian automaker Stellantis faced a significant drop of 25% after announcing a large financial charge related to its electric vehicle strategy.

Asian markets experienced declines, except for Japan’s Nikkei 225, which increased by 0.8%, driven by Toyota Motor’s stock performance.

As the stock market outlook appears bullish, investors are advised to stay informed about ongoing developments and the implications of tech spending and cryptocurrency trends.