ASX Poised to Rise Amid Wall Street Rally; Bitcoin Surges

The Australian sharemarket is experiencing a rebound, recovering from significant losses incurred the previous week. This upswing is largely in response to a strong rally on Wall Street.

ASX Performance Overview

In early trading, the S&P/ASX 200 index increased by 131.4 points, a rise of 1.5%. This positive shift sees all 11 industry sectors thriving after a 2% dip on Friday.

Sector-wise Gains

- Technology: Stocks experienced a resurgence after prior losses. WiseTech rose by 4.3%, TechnologyOne increased by 5.1%, and NextDC climbed by 3.6%.

- Mining: BHP led with a 2% gain, followed by Rio Tinto at 1.4% and Fortescue at 1.3%.

- Gold: Northern Star saw a 2.1% rise, while Evolution Mining gained 2.4%.

- Financials: Commonwealth Bank and Westpac each increased by 0.5%. National Australia Bank rose by 0.3%, and ANZ Bank surged by 0.8%.

- Consumer Finance: Pepper Money jumped significantly by 25.6% due to a takeover bid from Challenger, whose shares fell by 3.7%.

- Energy: Woodside Energy crept up by 1%, with Santos and Yancoal both increasing by 1.6%.

Wall Street Rally Influence

The rally in the U.S. markets bolstered these gains. On Friday, the S&P 500 surged by 2%, marking its strongest performance since May. The Dow Jones soared by 1,206 points, reaching over 50,000 for the first time, while the Nasdaq composite increased by 2.2%.

Key Drivers of Wall Street Gains

- Chip Companies: Nvidia and Broadcom significantly contributed to the rally, with Nvidia rising by 7.8%.

- Investment in Technology: Amazon CEO Andy Jassy announced a projected $200 billion investment aimed at technology sectors like AI and robotics, further driving market optimism.

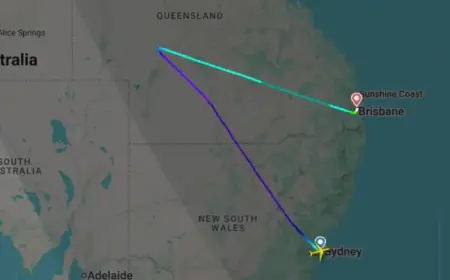

Bitcoin’s Recovery

Bitcoin has also made noteworthy gains, stabilizing after a tumultuous period. After dipping below $60,000, it regained momentum, trading at $70,361.

Impact on Related Market Stocks

- Robinhood Markets rose by 14%, marking the most substantial gain in the S&P 500.

- Coinbase Global experienced an uptick of 13%.

- Strategy, a bitcoin holding firm, soared by 26.1%.

Consumer Sentiment Insights

A preliminary report from the University of Michigan indicated a slight improvement in consumer sentiment, especially among households with stock holdings. However, sentiment remains low for those without such investments.

As the market continues to respond positively to these developments, analysts will be watching closely. The interplay between the ASX, Wall Street, and the cryptocurrency markets remains vital for investors.