Silver price today: spot holds near $79–$80 as volatility remains elevated

Silver prices were firmer into Sunday evening as the market tried to stabilize after a whipsaw stretch that has featured unusually large daily swings. As of 6:14 p.m. ET on Sunday, Feb. 8, 2026, spot silver was about $79.26 per troy ounce, while front-month silver futures were trading around the high-$70s.

Even with the late-day uptick, silver remains in a high-volatility regime where sharp reversals have been common—driven by rapid shifts in risk appetite, margin dynamics, and short-term positioning.

Silver spot price and key levels

Spot silver near $79–$80 places the metal in the middle of its recent trading band after a sharp pullback from late-January highs and several fast rebounds. Traders have been watching whether silver can hold above the upper-$70s for more than a session or two at a time—an informal “stability test” after repeated spikes and dips.

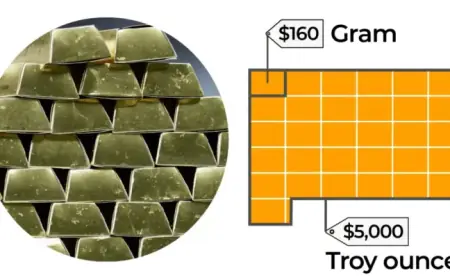

For many buyers, the more practical question is not just the headline spot number, but how quickly it’s moving. In a volatile tape, premiums on coins and small bars can widen, and the “real” price paid can drift well above the spot quote.

Today’s prices in common units

Here are the main benchmarks using the latest spot reading and a representative front-month futures quote (rounded where needed):

| Measure | Price (USD) |

|---|---|

| Spot silver (1 troy oz) | $79.26 |

| Spot silver (1 gram) | $2.55 (approx.) |

| Spot silver (1 kilogram) | $2,548 (approx.) |

| Silver futures (front month, 1 oz) | ~$79.41 (approx.) |

Small differences across screens reflect timing, bid/ask spreads, and whether the quote is spot or futures.

Why silver is still swinging so hard

Silver often behaves like a hybrid: part precious metal, part industrial input. That gives it more “personality” than gold when markets are unstable. In the past two weeks, several forces have amplified the moves:

-

Positioning and margin sensitivity: Fast rallies and selloffs can trigger rapid de-risking, especially in leveraged products.

-

Macro cross-currents: Shifts in rate expectations and the U.S. dollar can move precious metals quickly, and silver tends to exaggerate those moves.

-

Liquidity realities: Silver’s market depth is smaller than some other major assets, so concentrated flows can push prices harder in either direction.

The result: a price that can look calm for hours, then gap sharply on a single burst of activity.

What matters next for watchers and buyers

Near-term, the market is focused on whether silver can trade “normally” again—meaning tighter intraday ranges and fewer abrupt air pockets. Two practical signposts are emerging:

-

Support behavior: If silver repeatedly bounces in the upper-$70s, it suggests dip buyers are still active.

-

Follow-through: If rallies stall quickly near the low-$80s, it signals sellers are using strength to reduce exposure.

For physical buyers, the key is to compare spot vs. all-in purchase price, including premiums and shipping, because those add-ons can change quickly when volatility spikes.

Sources consulted: Kitco; CME Group; APMEX; Investing.com