Gold’s Value: Analyzing Prices, Global Reserves, and Market Trends

Gold has emerged as a prominent investment option amid fluctuating economic conditions and rising geopolitical tensions. On January 29, gold prices reached an unprecedented high of $5,600 per ounce, settling just below $5,000 recently. This upward trend has drawn more investors toward gold as a secure asset.

Understanding Gold’s Value

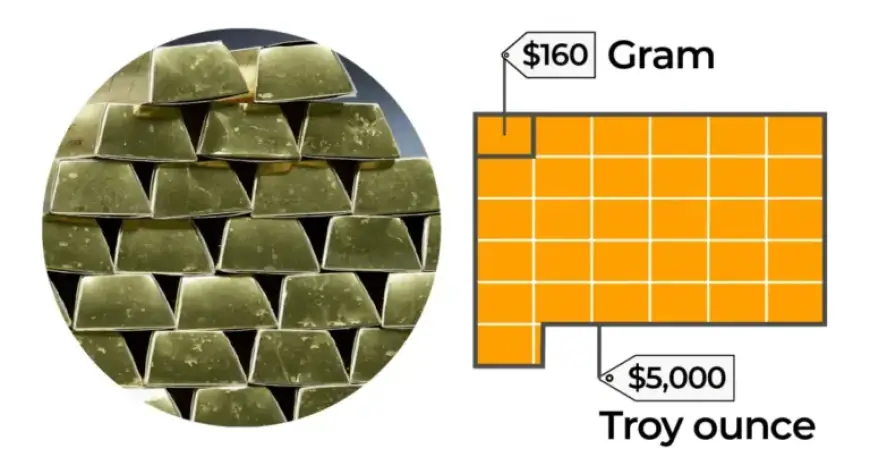

The value of gold is primarily influenced by its weight and purity. Gold is measured in troy ounces, where one troy ounce is equivalent to 31.1035 grams. As of the current market rate, one gram of gold is priced around $160, while a standard 400-troy-ounce gold bar, weighing about 12.44 kilograms, costs approximately $2 million.

Weight and Pricing

- 1 troy ounce = 31.1035 grams

- 1 gram of gold ≈ $160

- 400-troy-ounce gold bar ≈ $2 million

It is important to differentiate troy ounces from regular ounces, which weigh 28.35 grams and are typically used for measuring everyday items.

Gold Purity

Gold purity is measured in karats, with pure gold being classified as 24 karats. Lower karat values indicate a mix with other metals. Common gold classifications include:

- 24 karat: 99.9% purity, deep orange color, primarily used for investment coins.

- 22 karat: 91.6% purity, rich orange color, commonly found in luxury jewelry.

- 18 karat: 75% purity, warm yellow color, frequently used in fine jewelry.

- 9 karat: 37.5% purity, pale yellow color, typically used in affordable jewelry.

Historical Context of Gold Prices

Gold has a rich history as a form of currency and investment, with its value serving various economic roles. Until 1971, the U.S. dollar was directly linked to gold. The price for an ounce of gold was set at $20 between 1834 and 1933 before rising to $35 during the Great Depression. Following 1971, the market began determining gold prices independently.

Since 2016, gold prices have experienced significant growth, quadrupling from approximately $1,250 to around $5,000 today.

Global Gold Pricing Influences

Gold prices vary worldwide, largely based on the spot market where one troy ounce is traded for U.S. dollars. Local market prices depend on currency conversions, local supply and demand dynamics, and associated premiums for minting and distribution. Additionally, taxes can also affect gold prices:

- India: 3% GST on gold purchases

- United Kingdom: No taxes on gold investments

- United Arab Emirates: No taxes on gold investments

Countries with Largest Gold Reserves

Gold reserves are concentrated in a few countries worldwide. The United States holds the largest reserves, followed by Germany and Italy. The ranking for the top three countries is as follows:

- United States: 8,133 tonnes

- Germany: 3,350 tonnes

- Italy: 2,451 tonnes

This information highlights gold’s enduring value as both an investment and a global economic standard.