Binance Boosts Trump Family’s Crypto Business

World Liberty Financial, the cryptocurrency venture linked to the Trump family, achieved a noteworthy milestone last month. The company’s primary digital currency, USD1, reached a total circulation of $5 billion, establishing itself among the leading cryptocurrencies globally. Eric Trump, the president’s second son, celebrated this achievement with enthusiasm on social media.

Partnership with Binance

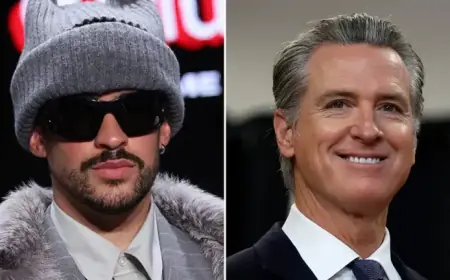

This substantial success can largely be attributed to a partnership with Binance, the world’s largest cryptocurrency exchange. Founded by billionaire Changpeng Zhao, Binance has recently become an essential element in the Trump family’s crypto business. Over the past two months, Binance has implemented several marketing promotions, encouraging users to purchase USD1, World Liberty’s stablecoin.

Market Penetration and Holdings

- Approximately 85% of USD1 coins are held within Binance accounts.

- Binance’s operations are currently restricted to markets outside the United States.

Jon Reiter, co-founder of the data firm ChainArgos, noted that Binance has always been the primary venue for trading USD1. The relationship has attracted scrutiny from ethics experts and some Congressional members due to potential conflicts of interest, given President Trump’s dual role as a crypto mogul and industry policymaker.

Political Implications

The White House supports legislation aimed at facilitating crypto exchanges’ operations within the U.S. Recent pardons granted to Changpeng Zhao by Trump could enable Binance to enter the U.S. market. This ongoing partnership has further solidified since the pardon, despite growing political pressure against the Trump family’s crypto business.

Promotional Strategies

- In December, Binance began allowing customers to convert other stablecoins to USD1 without fees.

- A promotional offering on January 22 included a share of $40 million in rewards for users storing USD1.

These promotions have led to a significant increase in trading activity, with USD1 transactions worldwide growing by nearly $2 billion in just a week.

Revenue and Investment Strategy

World Liberty generates potential revenue through strategic investments in government money-market funds, yielding an annual return of approximately 4%. With $5 billion invested, this could amount to $200 million in potential revenue. A spokesperson emphasized that promotional incentives are funded by the Trump company, rather than Binance.

Market Dynamics and Legal Considerations

The promotions initiated by Binance align with ongoing legislative discussions in Congress regarding stablecoin regulation. The GENIUS Act imposed restrictions on stablecoin issuers, yet permitted exchanges to offer interest payments, creating legal gray areas. While Binance remains free to offer incentives worldwide, U.S. regulations could affect similar offerings in the domestic market.

In summary, the partnership between World Liberty and Binance illustrates a complex interplay of business strategies, political influences, and evolving regulatory environments in the cryptocurrency sector. As the Trump family continues to expand its crypto empire, the implications for both the market and potential regulatory responses remain to be seen.